Get the free ity G - theleaderinme

Show details

PL

E

M

SALevel1Guide

it G

activity

Act

giddier Parents and Guardians, PLE Our class has chosen to use this activity guide, The Leader in Me, as an introduction

to personal leadership. All students

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ity g - formleaderinme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ity g - formleaderinme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

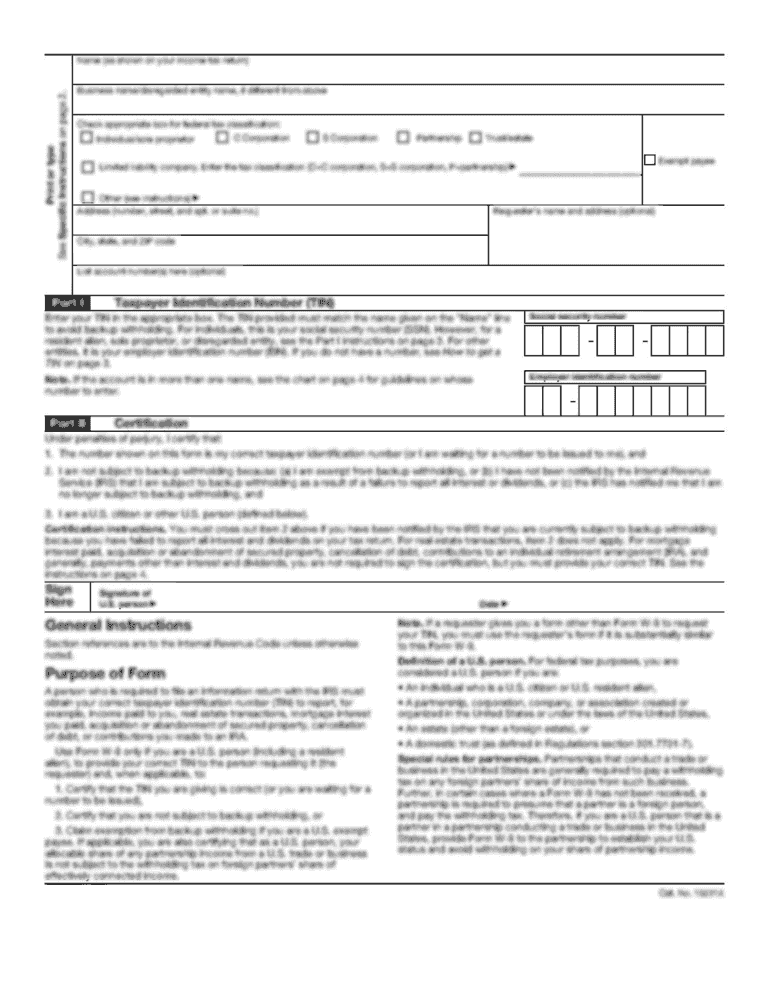

Editing ity g - formleaderinme online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ity g - formleaderinme. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

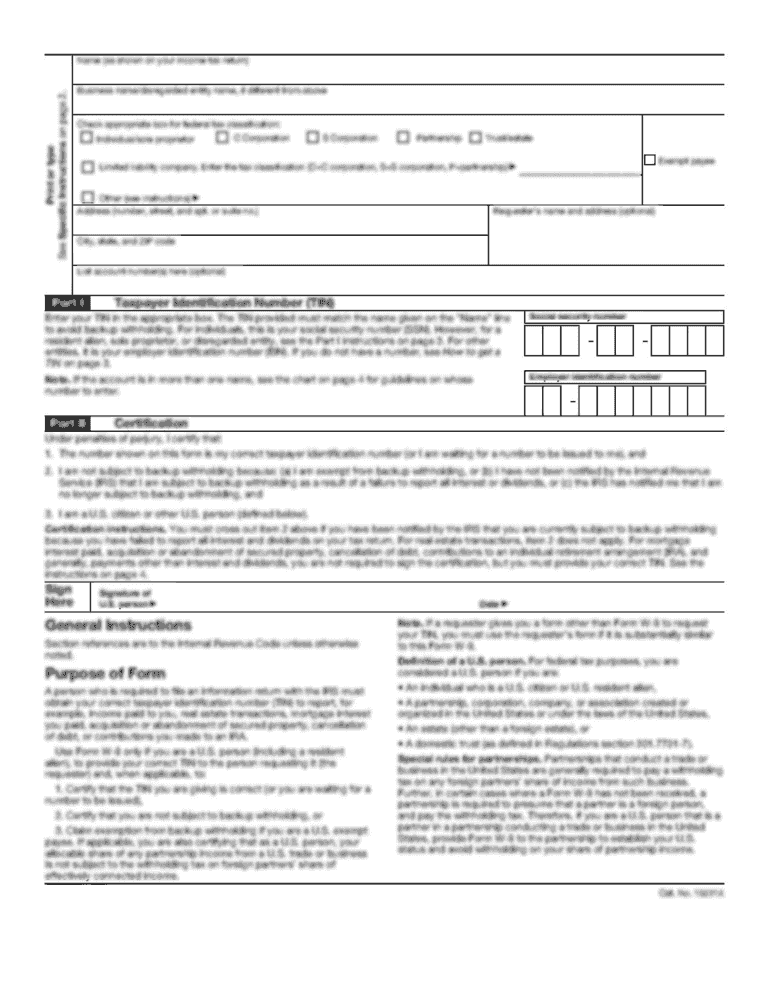

How to fill out ity g - formleaderinme

How to fill out ity g:

01

Start by gathering all the necessary information and documents required for filling out ity g. This may include personal identification, financial records, and any relevant supporting documents.

02

Carefully read through the instructions provided with ity g to ensure you understand the requirements and any specific guidelines or sections that need to be completed.

03

Begin filling out the form by accurately entering the requested information in each section. Pay close attention to spelling and ensure all information is entered correctly.

04

If you encounter any unfamiliar or unclear terms or questions, consult the provided instructions or seek clarification from a professional, such as a financial advisor or tax expert.

05

Double-check all the completed sections of ity g for any errors or missing information. It is important to review and proofread before submitting to avoid potential issues or delays.

06

Once you are satisfied with the completed form, sign and date it as required. If there are additional signatures needed, make sure to obtain them from the relevant individuals.

07

Keep a copy of the filled-out ity g for your records and submit the original form according to the provided instructions. This may involve mailing it to the designated address or submitting it electronically through an online platform.

Who needs ity g:

01

Individuals who are required to report their income and pay taxes to the appropriate tax authority.

02

Self-employed individuals or freelancers who need to declare their earnings and expenses for tax purposes.

03

Businesses or corporations that are obligated to file their annual tax returns and provide supporting financial information.

04

Anyone who has received income from investments, rental properties, or other sources that need to be reported for tax purposes.

05

Non-profit organizations that must provide detailed financial statements and reports to maintain their tax-exempt status.

06

Individuals or entities who may be eligible for tax deductions or credits and need to fill out ity g to claim these benefits.

07

Any taxpayer who has had a change in their circumstances, such as getting married, having a child, or moving to a different tax jurisdiction, may also need to fill out ity g to update their tax information.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ity g?

Ity g is a form used for reporting information related to income, expenses, and deductions for tax purposes.

Who is required to file ity g?

Individuals and businesses who meet certain criteria set by the tax authorities are required to file ity g.

How to fill out ity g?

Ity g can be filled out either manually or electronically, following the instructions provided by the tax authorities.

What is the purpose of ity g?

The purpose of ity g is to report financial information accurately to calculate tax obligations.

What information must be reported on ity g?

Information such as income, expenses, deductions, and tax credits must be reported on ity g.

When is the deadline to file ity g in 2023?

The deadline to file ity g in 2023 is typically April 15th, but it may vary depending on individual circumstances.

What is the penalty for the late filing of ity g?

The penalty for the late filing of ity g can vary depending on the jurisdiction, but it typically involves a financial fine or interest on unpaid taxes.

How can I edit ity g - formleaderinme on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ity g - formleaderinme.

Can I edit ity g - formleaderinme on an iOS device?

Create, edit, and share ity g - formleaderinme from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete ity g - formleaderinme on an Android device?

On Android, use the pdfFiller mobile app to finish your ity g - formleaderinme. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your ity g - formleaderinme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.