Get the free CCA Official Filing

Show details

This document serves as an official notice regarding the taking of a deposition by Florida Power & Light Company, related to a petition for authority to recover storm restoration costs associated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cca official filing

Edit your cca official filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cca official filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cca official filing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cca official filing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cca official filing

How to fill out CCA Official Filing

01

Gather necessary information: Collect all required documents, including identification and financial records.

02

Complete the application form: Fill out the CCA Official Filing form accurately, ensuring all sections are completed.

03

Review for accuracy: Double-check all entries for correctness to prevent delays or rejections.

04

Submit the form: Send the completed form along with any required attachments to the appropriate CCA office.

05

Pay any applicable fees: Ensure all fees are paid as outlined in the instructions.

06

Await confirmation: Check for a confirmation notice or receipt of your filing.

Who needs CCA Official Filing?

01

Individuals applying for a credit account.

02

Businesses seeking to establish credit reports.

03

Anyone needing to report or update personal credit information.

04

Entities required to comply with CCA regulations.

Fill

form

: Try Risk Free

People Also Ask about

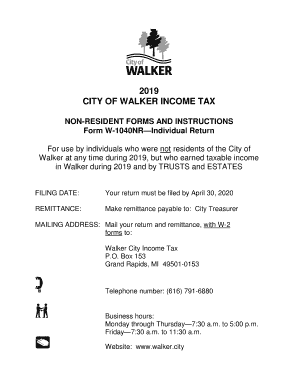

What is a CCA municipality in Ohio?

This requirement applies to individuals who earn income within the city. The city of Cleveland hasMoreThis requirement applies to individuals who earn income within the city. The city of Cleveland has its own income tax rate which must be considered when filing. If you live in Cleveland.

What is the CCA form?

The Central Collection Agency (CCA) is dedicated to the fair and efficient collection of municipal income taxes for the City of Cleveland and surrounding communities. Our mission is to provide taxpayers with transparent, accessible services while helping municipalities fund essential public services.

Do I need to claim CCA?

You do not have to claim the maximum amount of CCA in any given year. You can claim any amount you like, from zero to the maximum allowed for the year. If you do not have to pay income tax for the year, you may not want to claim CCA . Claiming CCA reduces the balance of the class by the amount of CCA claimed.

What is a CCA for taxes?

Claiming capital cost allowance (CCA) You might acquire a depreciable property, such as a building, furniture or equipment, to use in your business or professional activities. Since these properties may wear out or become obsolete over time, you can deduct their cost over a period of several years.

Do you have to take CCA?

You are not required to claim the full maximum amount in any given year; you can choose to claim any amount between zero and the maximum. If you do not have income tax to pay for the year, you might opt not to claim CCA.

Do I need to file CCA?

Filing Requirements - Am I required to file an annual CCA Individual City Tax Form? You must file a CCA Individual City Tax Form or Exemption Certificate (including retired people, public assistance, etc.) if one or more of the following applies to you: Live in a CCA member municipality that has mandatory filing.

Is CCA the same as depreciation?

CCA: Also known as “Capital cost allowance” for short. In simple terms, the CCA is the tax version of depreciation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CCA Official Filing?

CCA Official Filing is a formal submission required by regulatory authorities that includes detailed information about a company's financial status, compliance with laws, and operational activities.

Who is required to file CCA Official Filing?

Typically, all registered businesses and companies operating within the jurisdiction where the CCA is enforced must file CCA Official Filing, particularly those engaged in regulated industries.

How to fill out CCA Official Filing?

To fill out CCA Official Filing, one must gather necessary documentation, complete the required forms with accurate information, ensure compliance with guidelines, and submit the forms by the due date.

What is the purpose of CCA Official Filing?

The purpose of CCA Official Filing is to maintain transparency in the business sector, ensure regulatory compliance, and provide stakeholders with accurate financial and operational information.

What information must be reported on CCA Official Filing?

The information reported typically includes financial statements, details of business operations, compliance with laws and regulations, and disclosures related to financial performance and risks.

Fill out your cca official filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cca Official Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.