Get the free pafs 702 form

Show details

UNDERSTANDING YOUR DAMS (Active Component) LEAVE AND EARNINGS STATEMENT Defense Finance and Accounting Service Cleveland Center Code PDMF June 2002 Your pay is your responsibility. This publication's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pafs 702 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pafs 702 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pafs 702 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form pafs 702. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out pafs 702 form

How to fill out pafs 702:

01

Start by obtaining a copy of the pafs 702 form from the relevant authority.

02

Carefully read and understand the instructions provided with the form.

03

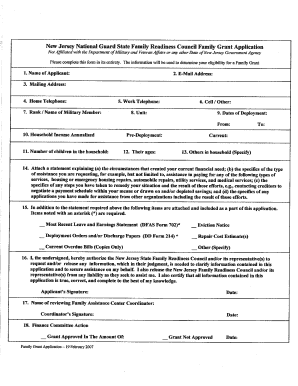

Begin by filling out the top section of the form, which typically includes personal information such as name, contact details, and identification number.

04

Move on to the next section, which may require you to provide specific details about your employment or business.

05

Fill out any sections related to income and expenses, ensuring that you provide accurate and up-to-date information.

06

If applicable, complete any sections related to assets, liabilities, or other relevant financial information.

07

Review the completed form for any errors or omissions and make any necessary corrections.

08

Sign and date the form at the designated area to certify its accuracy and completeness.

09

Submit the filled-out pafs 702 form to the appropriate authority as per the instructions provided, keeping a copy for your records.

Who needs pafs 702:

01

Individuals or business owners who are required to report their financial information to the relevant authority.

02

Those who are applying for financial aid or assistance and need to provide detailed financial documentation.

03

Organizations or institutions requesting financial information for auditing or compliance purposes.

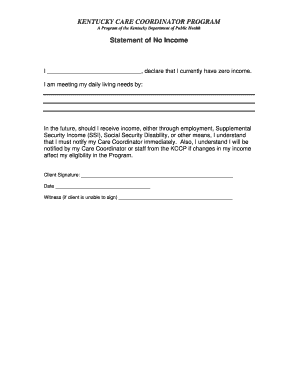

Fill pafs 702 kentucky : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

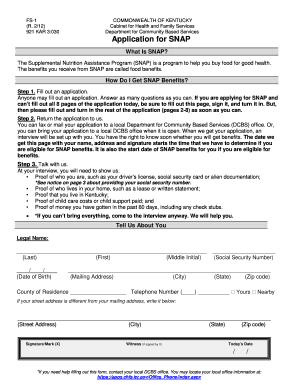

What is pafs 702?

PAFS 702 is a course offered by the Pennsylvania Association for Sustainable Agriculture (PASA). It is designed to provide an introduction to sustainable agriculture and explore the principles, practices, and policies that can help farmers transition to and maintain sustainable production systems. Topics covered include soil fertility and soil health, integrated pest management, cover crops, diversified cropping systems, and an introduction to organic certification.

Who is required to file pafs 702?

The State of California requires employers with more than 25 employees to complete and submit the Form PA-FS-702, California Employer Contribution Return and Report of Wages, each quarter.

What is the penalty for the late filing of pafs 702?

The penalty for late filing of PAFs 702 is a late filing fee of $100 per return. Additionally, any applicable late-payment penalty and interest may be imposed, depending on the amount of the tax due.

How to fill out pafs 702?

PAFS 702 refers to the Personal Assets and Liabilities Statement form that may vary depending on the specific organization's requirements. However, there are certain general instructions that apply to most PAFS 702 forms. Here are the steps to fill out a PAFS 702 form:

1. Gather all necessary financial information: Collect all pertinent documents such as bank statements, investment account statements, real estate documents, loan statements, credit card statements, vehicle information, and any other relevant financial information.

2. Familiarize yourself with the form: Review the PAFS 702 form to understand the various sections and fields that need to be completed. Pay attention to any specific instructions or guidelines mentioned.

3. Fill in personal details: Start by filling in your personal information such as your full name, address, contact information, and any other identification details requested.

4. Provide asset details: Move on to the section for assets. This typically includes categories such as cash and bank accounts, investments, real estate, vehicles, and other assets. List each asset separately, providing accurate details such as the name of the account or property, its current value, and any outstanding loans or mortgages associated with it.

5. Disclose liabilities: In the following section, you need to list your liabilities, such as loans, mortgages, credit card debts, and any other outstanding debts. Again, provide details including the name of the debt, outstanding balance, monthly payment amount, and any relevant interest rates.

6. Calculate net worth: Many PAFS 702 forms contain a section that automatically calculates your net worth. This is often the difference between your total assets and total liabilities. Ensure that all your entries are accurately included in the calculation.

7. Review and double-check: Before submitting the form, thoroughly review all the information you have entered. Check for any errors or omissions. Make sure that your values are accurate and consistent throughout the form.

8. Sign and date: Once you are satisfied with the form, sign and date it. Some PAFS 702 forms may require additional witness signatures or verification, so ensure you comply with any specific instructions.

9. Retain a copy: Make a copy of the filled-out form for your records before submitting it as necessary.

Remember, the instructions provided here are general guidelines, and it's essential to refer to the specific instructions for the PAFS 702 form you are required to fill out.

What information must be reported on pafs 702?

PAFS 702 is a form used to report the financial statements and information of an organization. The specific information that must be reported on PAFS 702 may vary depending on the regulations and requirements of the reporting authority. However, generally, the following information is commonly reported on PAFS 702:

1. Organization Details: Name, address, and other basic information about the organization.

2. Financial Statements: Comprehensive financial statements including income statement, balance sheet, cash flow statement, and statement of changes in equity.

3. Notes to Financial Statements: Additional explanations, disclosures, and details related to the financial statements.

4. Significant Accounting Policies: Description of the significant accounting policies adopted by the organization.

5. Auditor's Report: Independent auditor's report providing an opinion on the fairness of the financial statements.

6. Management Discussion and Analysis: Narrative analysis and commentary on the financial performance, results, and outlook of the organization.

7. Statement of Compliance: Confirmation that the financial statements are prepared in accordance with the applicable accounting standards, rules, or regulations.

8. Internal Controls: Description of the organization's internal control systems and procedures to ensure accurate financial reporting.

9. Other Disclosures: Any other relevant information or disclosures required by the reporting authority, such as related party transactions, contingent liabilities, and subsequent events.

It is important to note that the specific requirements for information on PAFS 702 may vary depending on the jurisdiction, reporting framework (e.g., International Financial Reporting Standards, Generally Accepted Accounting Principles), and the type and size of the organization.

How do I execute pafs 702 online?

Completing and signing form pafs 702 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in pafs 702 form ky?

The editing procedure is simple with pdfFiller. Open your pafs 702 proof of no income in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I edit pafs 702 proof of no income form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form pafs 702 proof of no income from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your pafs 702 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pafs 702 Form Ky is not the form you're looking for?Search for another form here.

Keywords relevant to printable pafs 702 form

Related to pafs 702 form ky template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.