Get the free Gebruik van de fiscaalbox in het voertuig - transscope

Show details

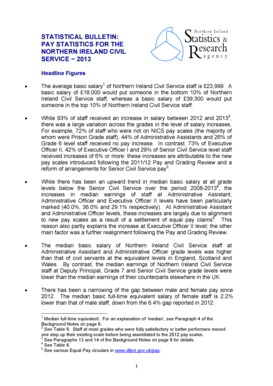

Hebrew van de fiscaalbox in he overtook.

In it document word her vault began DAT u been Fiscaalbox heft met DE Optional

startonderbreker en DE GPS.

In he overtook heft u been Fiscaalbox kitten.

Dee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gebruik van de fiscaalbox form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gebruik van de fiscaalbox form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gebruik van de fiscaalbox online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gebruik van de fiscaalbox. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out gebruik van de fiscaalbox

How to fill out gebruik van de fiscaalbox:

01

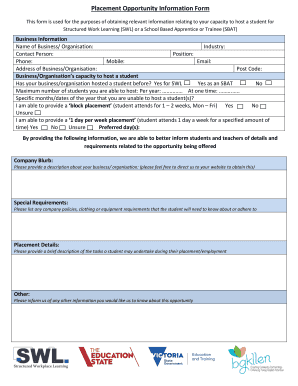

Start by gathering all the necessary documents such as your income statements, tax forms, and any relevant deductions or credits.

02

Carefully review the instructions and guidelines provided by the tax authorities regarding the gebruik van de fiscaalbox.

03

Determine your eligibility for the fiscaalbox by examining your income sources and their nature (e.g., employment income, self-employment income, rental income) to see if they fall within the scope of the fiscaalbox.

04

Calculate your total income for the relevant tax year, including any income that qualifies for the fiscaalbox.

05

Identify and categorize the income that falls under the fiscaalbox. This includes income such as dividends, capital gains, and certain forms of income from savings and investments.

06

Determine the specific tax rates and rules applicable to each type of income within the fiscaalbox category.

07

Fill out the appropriate sections of your tax return form or software, ensuring that you accurately report the income attributable to the fiscaalbox.

08

Provide any necessary supporting documentation for the income attributed to the fiscaalbox, such as stock trade confirmations or interest statements.

09

Double-check all information entered to ensure accuracy and completeness.

10

Submit your completed tax return form or software, either electronically or via mail, within the designated filing deadline.

Who needs gebruik van de fiscaalbox:

01

Individuals who receive income from dividends or capital gains may need to utilize the fiscaalbox to properly account for and report this income for tax purposes.

02

Taxpayers who have income from savings and investments, such as interest or investment returns, may also need to use the fiscaalbox to determine the applicable tax rates and rules for reporting this income accurately.

03

Self-employed individuals or those with rental income that falls within the scope of the fiscaalbox will need to understand and properly fill out the necessary sections related to this type of income on their tax return.

04

Individuals with complex financial situations, multiple income sources, or significant investments should consult with a tax advisor or professional to ensure they correctly fill out the gebruik van de fiscaalbox and maximize any applicable tax benefits or deductions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gebruik van de fiscaalbox?

Gebruik van de fiscaalbox refers to the utilization of tax breaks or incentives provided by the government.

Who is required to file gebruik van de fiscaalbox?

Individuals or businesses that qualify for tax benefits or deductions under the fiscaalbox system are required to file for its use.

How to fill out gebruik van de fiscaalbox?

To fill out gebruik van de fiscaalbox, taxpayers need to report their eligibility for tax incentives and provide supporting documentation.

What is the purpose of gebruik van de fiscaalbox?

The purpose of gebruik van de fiscaalbox is to encourage investment, savings, or certain activities by providing tax advantages to individuals or businesses.

What information must be reported on gebruik van de fiscaalbox?

Taxpayers must report details of their investments, income sources, expenses, and any other relevant financial information to claim benefits under the fiscaalbox system.

When is the deadline to file gebruik van de fiscaalbox in 2023?

The deadline to file gebruik van de fiscaalbox in 2023 is typically the end of the fiscal year, which is usually December 31st.

What is the penalty for the late filing of gebruik van de fiscaalbox?

The penalty for the late filing of gebruik van de fiscaalbox may include fines, interest charges, or loss of tax benefits, depending on the specific regulations in place.

How do I modify my gebruik van de fiscaalbox in Gmail?

gebruik van de fiscaalbox and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I send gebruik van de fiscaalbox for eSignature?

Once you are ready to share your gebruik van de fiscaalbox, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I fill out the gebruik van de fiscaalbox form on my smartphone?

Use the pdfFiller mobile app to fill out and sign gebruik van de fiscaalbox on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your gebruik van de fiscaalbox online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.