Get the free INTEREST RATE PASS-THROUGH IN COLOMBIA:

Show details

INTEREST RATE WALKTHROUGH IN COLOMBIA: A MICROMANAGING PERSPECTIVE×Rock Betancourt Hernando Vargas Norberto Rodriguez**Boot, September 2006 *The opinions expressed in this paper are those of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your interest rate pass-through in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your interest rate pass-through in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit interest rate pass-through in online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit interest rate pass-through in. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out interest rate pass-through in

How to fill out interest rate pass-through:

01

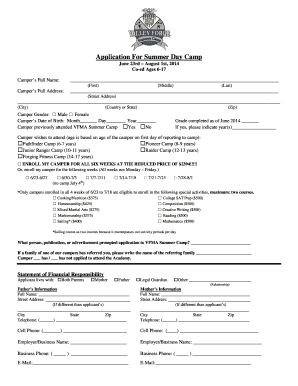

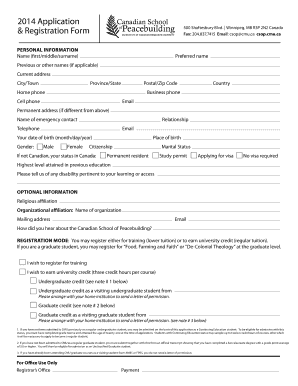

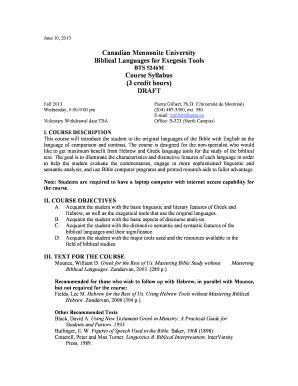

Gather the necessary information: In order to fill out the interest rate pass-through form, you will need to gather all the relevant financial information, such as the interest rates that are being passed through, the time period for which the pass-through is applicable, and any other additional details that may be required.

02

Understand the purpose of the form: It is crucial to understand why the interest rate pass-through form needs to be filled out. Generally, this form is used by financial institutions to ensure transparency and to comply with regulatory requirements. It helps to pass on the changes in short-term interest rates to borrowers or depositors.

03

Complete the required sections: The interest rate pass-through form typically consists of various sections that need to be completed accurately. These sections may include information about the financial institution, the specific interest rates being passed through, the effective date, and any supporting documentation if required. Ensure that you provide all the necessary details in a clear and concise manner.

04

Check for accuracy and consistency: Before submitting the form, carefully review all the information provided to ensure accuracy and consistency. Double-check the figures, dates, and any calculations involved. It is essential to avoid any errors or omissions that could lead to complications in the pass-through process.

05

Submit the form: Once you have filled out the interest rate pass-through form, follow the specific instructions provided by the relevant authority or institution. This might involve submitting the form electronically through an online portal or physically delivering a printed copy. Make sure to meet any deadlines or additional requirements indicated.

Who needs interest rate pass-through:

01

Banks and financial institutions: Interest rate pass-through is primarily needed by banks and other financial institutions. They use this mechanism to ensure that changes in short-term interest rates are passed on to borrowers or depositors accurately and fairly.

02

Borrowers: Borrowers, such as individuals or businesses with loans or mortgages, are also interested in the interest rate pass-through. It affects their borrowing costs and monthly payments. Understanding the interest rate pass-through helps borrowers anticipate and plan for potential changes in their financial obligations.

03

Depositors: Individuals or entities that have savings or fixed deposits with banks may also have an interest in the rate pass-through. The changes in short-term interest rates can impact the returns on their deposits. By knowing how the interest rate pass-through works, depositors can make informed decisions about their investments and potential returns.

Overall, the interest rate pass-through is essential for maintaining transparency and fairness in the financial industry. It benefits both financial institutions and individuals by ensuring that changes in interest rates are accurately captured and reflected in borrowing and deposit rates.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is interest rate pass-through in?

Interest rate pass-through in is the process by which changes in interest rates set by the central bank are transmitted to the interest rates set by financial institutions.

Who is required to file interest rate pass-through in?

Financial institutions are required to file interest rate pass-through in.

How to fill out interest rate pass-through in?

Interest rate pass-through in can be filled out by providing information on interest rate changes and their impact on financial institution rates.

What is the purpose of interest rate pass-through in?

The purpose of interest rate pass-through in is to ensure that changes in central bank interest rates are reflected in the interest rates set by financial institutions.

What information must be reported on interest rate pass-through in?

Information on interest rate changes, the timing of changes, and the correlation between central bank rates and financial institution rates must be reported on interest rate pass-through in.

When is the deadline to file interest rate pass-through in in 2023?

The deadline to file interest rate pass-through in in 2023 is typically in the first quarter of the year, around March or April.

What is the penalty for the late filing of interest rate pass-through in?

The penalty for the late filing of interest rate pass-through in may include fines or sanctions imposed by regulatory authorities.

How do I execute interest rate pass-through in online?

pdfFiller has made it simple to fill out and eSign interest rate pass-through in. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit interest rate pass-through in online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your interest rate pass-through in to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit interest rate pass-through in on an Android device?

You can make any changes to PDF files, like interest rate pass-through in, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your interest rate pass-through in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.