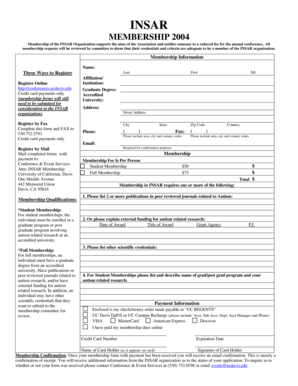

Get the free Charitable Donations - Artwork

Show details

Charitable Donations Artwork Category:OperationsNumber: Audience:All University PersonnelLast Revised:October 23, 2013Owner:Senior Financial OfficerApproved by:Board of GovernorsContact:Senior Financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable donations - artwork

Edit your charitable donations - artwork form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable donations - artwork form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable donations - artwork online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit charitable donations - artwork. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable donations - artwork

How to fill out charitable donations - artwork:

01

Begin by gathering all the necessary information about the artwork you are donating. This includes its title, artist, date of creation, medium, and estimated value. It's important to have all these details accurately documented.

02

To ensure that your donation is properly acknowledged, locate the charitable organization's donation form or request one from them. It may be available online or in a physical copy.

03

Fill out the donation form with your personal information, including your name, address, phone number, and email. Some forms may also require your social security number or tax identification number for tax-deductible purposes.

04

Specify the artwork you are donating by providing its details as mentioned earlier. Include any additional information that might be required by the organization, such as a photograph of the artwork or its current condition.

05

Indicate the estimated value of the artwork. It's crucial to be honest and realistic when determining the artwork's value. If you're unsure, you may consider seeking professional appraisal or consulting art experts.

06

Check if the organization has any specific guidelines or requirements regarding the donation process. They may have their own policies or restrictions, so make sure to adhere to them.

07

Once you have completed the donation form, review it for any errors or omissions. Ensure that all the information provided is accurate and consistent.

08

Submit the completed donation form to the charitable organization. Some organizations may prefer receiving it by mail, while others accept digital submissions via email or their website.

09

Keep a copy of the donation form for your records. This will serve as proof of your donation for tax or documentation purposes.

10

After submitting the donation form, the organization may provide you with an acknowledgment letter or receipt. This will confirm your donation and may be used for tax deductions, depending on the organization's status.

Who needs charitable donations - artwork?

01

Non-profit organizations, museums, or galleries that focus on art and cultural preservation often require charitable donations of artwork. These organizations rely on support from art enthusiasts to build their collections or hold exhibitions.

02

Artists or their estates may also choose to donate their artwork to charitable organizations as a way to contribute to a cause or leave a lasting legacy.

03

Art lovers who wish to make a meaningful impact and support artistic endeavors commonly engage in donating artwork to charitable organizations. By donating their own collection or acquiring art specifically for this purpose, individuals can contribute to the growth and appreciation of art while helping organizations fulfill their missions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is charitable donations - artwork?

Charitable donations - artwork refer to donations of artwork or artistic creations made to charitable organizations for a tax deduction.

Who is required to file charitable donations - artwork?

Individuals or organizations who have made donations of artwork with a total value exceeding $5,000 are required to file charitable donations - artwork.

How to fill out charitable donations - artwork?

To fill out charitable donations - artwork, individuals or organizations must provide detailed information about the artwork donated, its value, the name and address of the charitable organization, and the date of the donation.

What is the purpose of charitable donations - artwork?

The purpose of charitable donations - artwork is to incentivize donations of valuable artwork to charitable organizations by providing a tax deduction to the donor.

What information must be reported on charitable donations - artwork?

The information required to be reported on charitable donations - artwork includes the description and value of the artwork donated, the name and address of the charitable organization, and the date of the donation.

How can I modify charitable donations - artwork without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your charitable donations - artwork into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit charitable donations - artwork on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign charitable donations - artwork. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I edit charitable donations - artwork on an Android device?

With the pdfFiller Android app, you can edit, sign, and share charitable donations - artwork on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your charitable donations - artwork online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Donations - Artwork is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.