Who needs a form 943?

You will need to file the IRS 943 Form if you paid wages to one or more farmworkers and the wages were subject to social security and Medicare taxes or federal income tax withholding. If you’re not sure if your farmworkers wages were subject to these taxes, you can check with this test:

• You pay an employee cash wages of $150 or more in a year for farm work.

• The total (cash and noncash) wages that you pay to all farmworkers is $2,500 or more.

If the $2,500-or-more test for the group isn't met, the $150-or-more test for an individual still applies.

If you employ hand-harvest laborers and pay them less than $150 in annual cash wages, you do not need to fill out Form 943.

What is form 943 for?

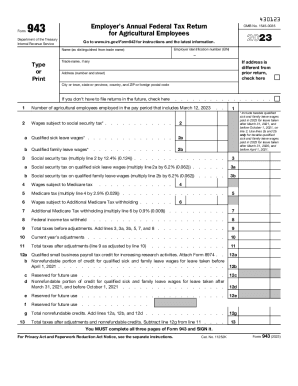

The IRS form 943 can require many pieces of information. It really depends on your tax situation. At the very least, you will need:

1. Your contact information such as phone number, full mailing address, etc.

2. Your business’ tax ID, also known as the Employer ID Number (EIN)

3. Your business’ financial records for the year, including employee wages

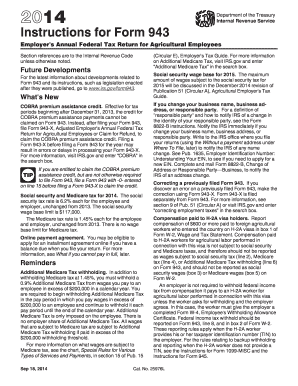

Is it accompanied by other forms?

The form is not accompanied by any other forms unless otherwise specified. If you want to make a payment with this form, please attach form 943-V, Payment Voucher to the original return.

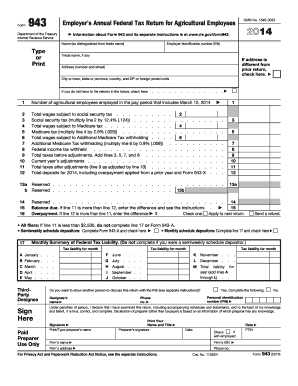

When is form 943 due?

In 2016 tax year the due date for filing form 943 is January 31, 2017.

How do I fill out a form 943?

See the instructions for each section of this form here.

Where do I send it?

Where you send a physical form depends on whether you include a payment with your return. If you are filing an amended return, send it to the “without a payment” address, even if a payment is included. The addresses for this can be found on the IRS instruction page for the 943 form.