Get the free CORE Insurance Requirements - PRE-CONSTRUCTION and PQ - TEMPLATE - 1-18-12

Show details

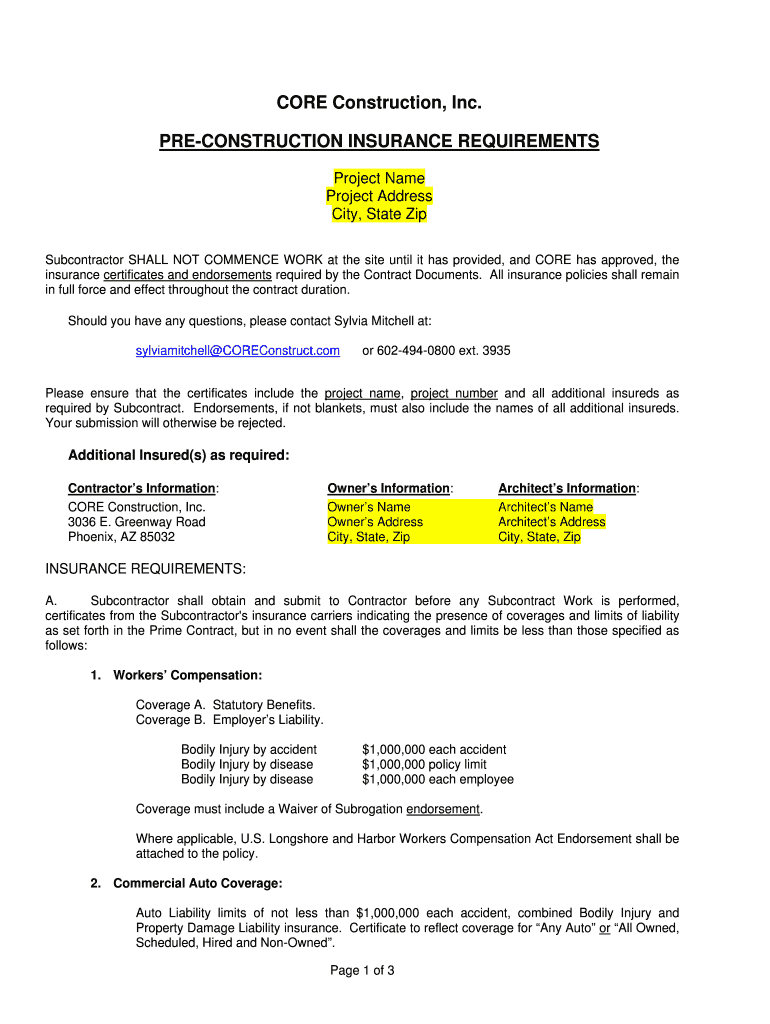

CORE Construction, Inc. PRECONSTRUCTION INSURANCE REQUIREMENTS Project Name Project Address City, State Zip Subcontractor SHALL NOT COMMENCE WORK at the site until it has provided, and CORE has approved,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign core insurance requirements

Edit your core insurance requirements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your core insurance requirements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit core insurance requirements online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit core insurance requirements. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out core insurance requirements

How to fill out core insurance requirements:

01

Start by carefully reviewing the insurance policy documents provided by the insurance company. These documents will outline the specific core insurance requirements that need to be fulfilled.

02

Identify the different categories of core insurance requirements, such as liability coverage, property coverage, and employee benefits. This will give you a clear understanding of what needs to be addressed.

03

Gather all necessary information and documents required to meet the core insurance requirements. This may include information about your business operations, assets, employees, and financial statements.

04

Identify any potential gaps or deficiencies in your current insurance coverage that may need to be addressed to meet the core requirements. Consult with your insurance provider to determine if additional policies or adjustments are needed.

05

Complete any necessary application forms or questionnaires provided by the insurance company. Ensure that all information is accurate and up to date.

06

Submit the completed application forms and any supporting documents to the insurance company. Keep copies of all submitted materials for your records.

07

Review any feedback or requests for additional information from the insurance company. Address any concerns or provide the requested information promptly.

08

Once the insurance company has reviewed your application and verified that all core insurance requirements have been met, they will issue a policy that is compliant with your specific needs.

Who needs core insurance requirements:

01

Individuals or businesses involved in high-risk activities such as construction, manufacturing, or healthcare often require core insurance requirements. This is to protect against potential liabilities and financial losses.

02

Business owners who want to ensure that their assets, property, and employees are adequately protected also need to fulfill core insurance requirements.

03

Professionals in certain industries, such as doctors, lawyers, and accountants, may have specific core insurance requirements imposed by their regulatory bodies or professional associations.

04

Lenders or financial institutions may require borrowers to fulfill certain core insurance requirements as part of their loan agreement to mitigate risk.

In summary, filling out core insurance requirements involves understanding the specific requirements, gathering necessary information, completing application forms, addressing potential coverage gaps, and submitting the application to the insurance company. These requirements are needed by individuals or businesses involved in high-risk activities, those who want to protect assets and employees, professionals in certain industries, and borrowers securing loans from financial institutions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit core insurance requirements online?

The editing procedure is simple with pdfFiller. Open your core insurance requirements in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit core insurance requirements on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute core insurance requirements from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete core insurance requirements on an Android device?

Use the pdfFiller Android app to finish your core insurance requirements and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is core insurance requirements?

Core insurance requirements are the essential insurance coverages that an individual or entity must have in order to meet certain legal or contractual obligations.

Who is required to file core insurance requirements?

Certain industries or professions may be required by law or regulation to file core insurance requirements.

How to fill out core insurance requirements?

Core insurance requirements can typically be filled out by providing documentation or proof of the required insurance coverages.

What is the purpose of core insurance requirements?

The purpose of core insurance requirements is to ensure that individuals and entities have adequate insurance coverage to protect themselves and others in the event of certain risks or liabilities.

What information must be reported on core insurance requirements?

Core insurance requirements typically require information such as the type of insurance coverage, policy limits, and the name of the insurance provider.

Fill out your core insurance requirements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Core Insurance Requirements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.