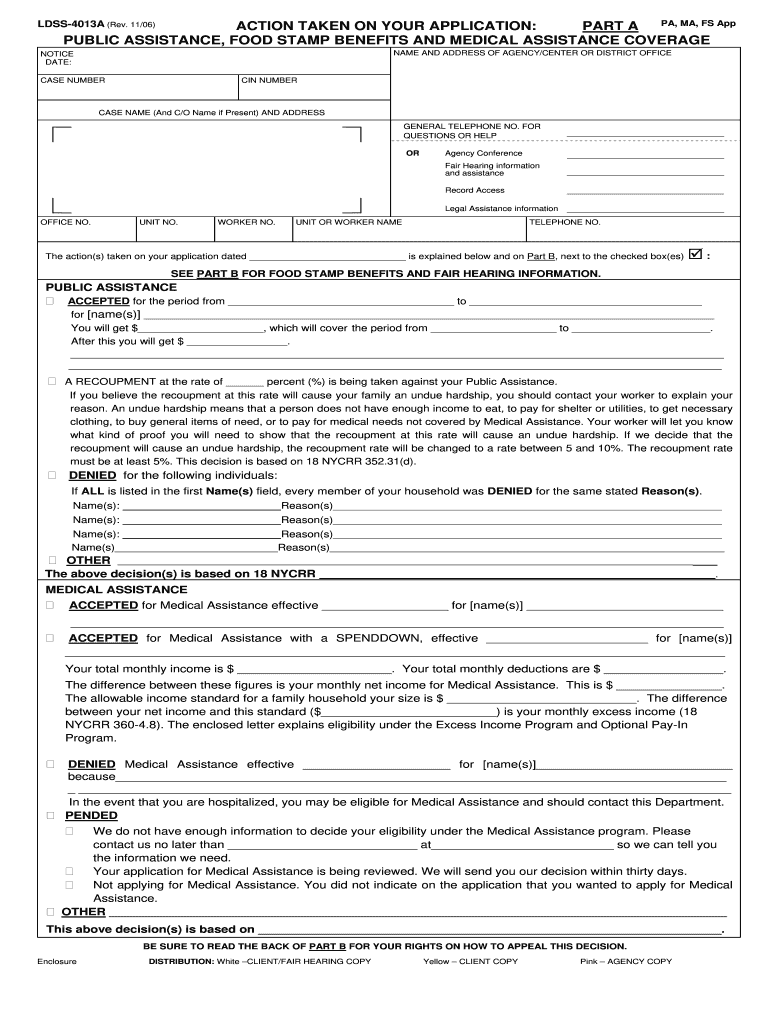

NY LDSS-4013A 2006 free printable template

Show details

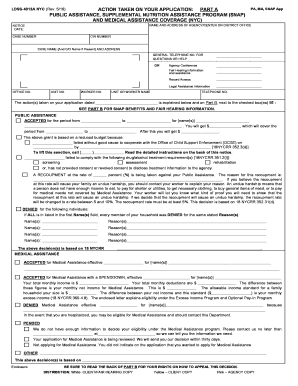

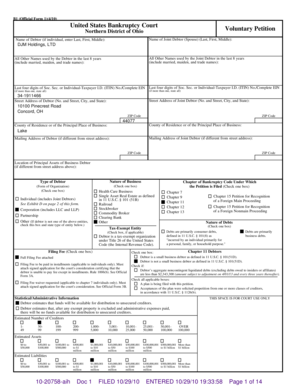

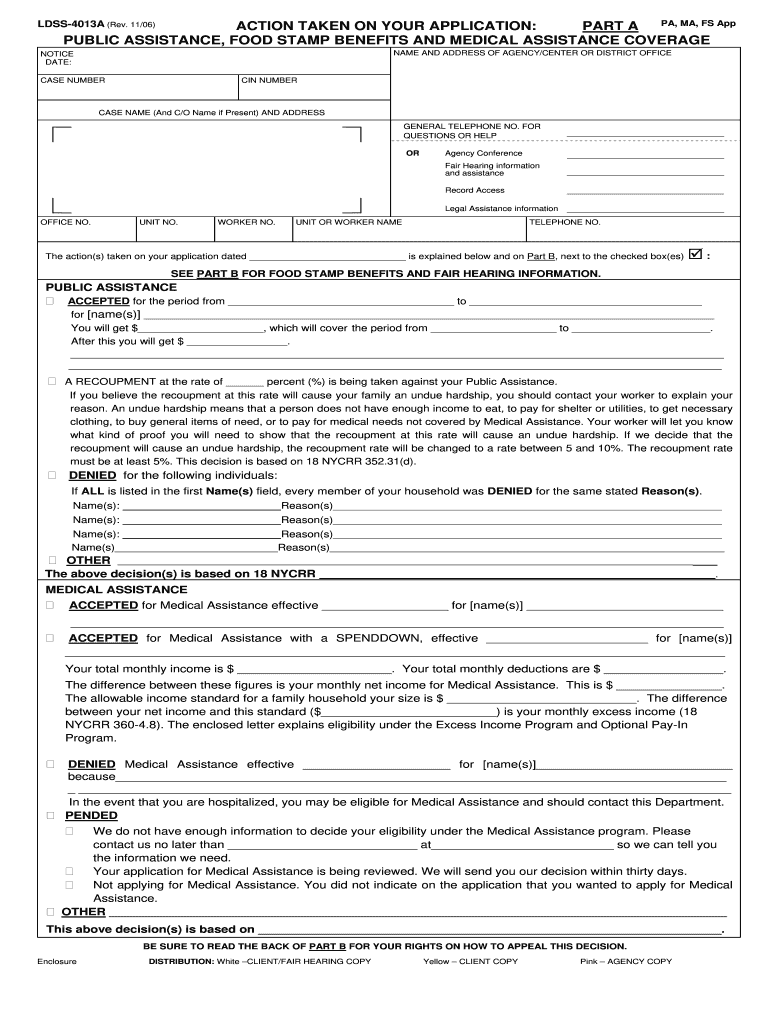

ACTION TAKEN ON YOUR APPLICATION PART A PA MA FS App PUBLIC ASSISTANCE FOOD STAMP BENEFITS AND MEDICAL ASSISTANCE COVERAGE LDSS-4013A Rev. 11/06 NAME AND ADDRESS OF AGENCY/CENTER OR DISTRICT OFFICE NOTICE DATE CASE NUMBER CIN NUMBER CASE NAME And C/O Name if Present AND ADDRESS GENERAL TELEPHONE NO.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your w532 form 2006 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w532 form 2006 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w532 form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit w 532 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

NY LDSS-4013A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out w532 form 2006

How to fill out w532 form:

01

Start by carefully reading the instructions provided with the form. It is essential to follow them accurately to ensure correct completion.

02

Begin by entering your personal information in the designated sections. This typically includes your full name, address, contact information, and social security number.

03

If applicable, provide details about your current employment, such as the company name, job title, and duration of employment.

04

The form may require you to disclose your income and financial information. Be prepared to provide accurate details about your earnings, assets, and any other relevant financial data.

05

If required, indicate any deductions or exemptions that apply to your situation. This may include dependents, tax credits, or other related information.

06

Review your completed form for any errors or omissions before submitting it. Double-check that all the required sections have been properly filled out and that the information provided is accurate.

07

Finally, sign and date the form as required, and submit it according to the instructions provided. Make sure to keep a copy for your records.

Who needs w532 form:

01

Individuals who have received income from a source other than traditional employment, such as rental income, self-employment earnings, or investment gains, may need to fill out the w532 form.

02

Those who qualify for specific tax credits or deductions, such as the Earned Income Tax Credit or Child Tax Credit, may also be required to complete this form to claim those benefits.

03

Individuals who have had federal income tax withheld from their non-employment income may need to complete the w532 form to request a refund or adjust the amount withheld.

Note: The specific requirements and circumstances for needing the w532 form may vary based on your jurisdiction and individual tax situation. It is advisable to consult with a tax professional or refer to the instructions provided with the form for accurate guidance.

Video instructions and help with filling out and completing w532 form

Instructions and Help about hra form w 532

Fill formulario w 532 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out w532 form?

W532 is a form issued by the Internal Revenue Service (IRS) to report the income and deductions for certain types of individuals, such as self-employed persons, business owners, and rental property owners.

To fill out Form W532, you will need to provide your name, address, and Social Security Number. You will also need to report the type of income you received, the amount of income you received, and any expenses you incurred related to that income. You will also need to report any deductions or credits that you are eligible for.

Once you have completed the form, you will need to sign and date it, and send it to the IRS. Make sure you keep a copy of the form for your records.

What information must be reported on w532 form?

The W-532 form is used to report state income tax refund information to the Internal Revenue Service (IRS). The form will include information such as the taxpayer's name, Social Security number, date of birth, address, state of residence, and the amount of the refund. Additionally, the form must include information on the type of tax (income, sales, etc.), the year the refund was received, and the IRS account number associated with the refund.

Who is required to file w532 form?

The W-532 form does not exist in the current IRS form database. It is possible that you may be referring to a different form or a form specific to a certain region or country. Please provide more information or clarify your question so that I can assist you better.

What is the purpose of w532 form?

There is no widely recognized or standardized form called W532. It is possible that the form you are referring to is specific to a certain organization, institution, or jurisdiction. To accurately determine the purpose of the form, you would need to provide more context or clarify the entity that uses the form.

How can I send w532 form to be eSigned by others?

When you're ready to share your w 532 form, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit w 532 form straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing form w 532.

How do I fill out the w532 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign w 532 letter to past or present employer form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your w532 form 2006 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

W 532 Form is not the form you're looking for?Search for another form here.

Keywords relevant to w 532 letter form

Related to form 532

If you believe that this page should be taken down, please follow our DMCA take down process

here

.