Get the free IRA Restricted Account and Plan Repayment Agreement - files ali-aba

Show details

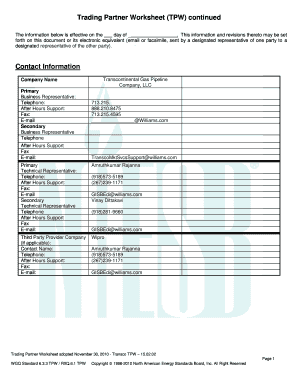

IRA RESTRICTED ACCOUNT AND PLAN REPAYMENT AGREEMENT This IRA Restricted Account and Plan Repayment Agreement Agreement is entered into this day of 20 by and among Participant The XYZ National Bank Custodian the ABC Defined Benefit Pension Plan and Trust Pension Plan and the ABC Company ABC.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira restricted account and

Edit your ira restricted account and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira restricted account and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira restricted account and online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ira restricted account and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira restricted account and

How to fill out IRA Restricted Account and Plan Repayment Agreement

01

Obtain the IRA Restricted Account and Plan Repayment Agreement form from your financial institution or relevant regulatory body.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Specify the type of IRA (Traditional, Roth, etc.) for which you're applying the restricted account.

04

Clearly state the reason for establishing the restricted account and the repayment terms.

05

Include details about the funds being restricted, including the amount and purpose.

06

Review the agreement for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed agreement to your financial institution or designated authority.

Who needs IRA Restricted Account and Plan Repayment Agreement?

01

Individuals looking to manage their retirement savings with specific restrictions.

02

Those who need to comply with legal or financial obligations regarding their IRA funds.

03

People who want to establish a repayment plan for loans taken from their IRA.

Fill

form

: Try Risk Free

People Also Ask about

Why can't I contribute to my IRA?

You or your spouse must have earned income to contribute. However you cannot contribute more than you make. If your household income is lower than the contribution limit, your annual contribution limit is lowered.

What is the 60-day repayment rule for IRAs?

You have 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control.

Why is my IRA restricted?

Higher income levels can reduce the amount you're allowed to contribute to a Roth IRA or make you ineligible for the year. If you're a single filer, for instance, your modified adjusted gross income (MAGI) must be at or below $150,000 for 2025 to contribute the maximum amount.

What are the restrictions on traditional IRA withdrawal?

You are eligible to make withdrawals without penalties or fees from a traditional IRA at age 59½, but you can also wait until you are older. For traditional IRAs you must begin taking withdrawals, or Required Minimum Distributions (RMDs), starting at age 73*, (or 72 if you were born before July 1, 1949).

How are IRA contributions restricted?

You also cannot contribute more to your IRAs than the income you earn each year. If your income is lower than the contribution limit, your annual IRA contribution may be limited to your earned income. For example, if your earned income is $5,000, your max contribution limit is $5,000.

Why is my Roth IRA restricted?

Higher income levels can reduce the amount you're allowed to contribute to a Roth IRA or make you ineligible for the year. If you're a single filer, for instance, your modified adjusted gross income (MAGI) must be at or below $150,000 for 2025 to contribute the maximum amount.

Can I have a traditional IRA and a 403b?

You can choose to participate in a 403(b) and an IRA, or you may consider forgoing the 403(b) and simply establish an IRA, either traditional or Roth. Whichever choice you make, you should not pass up this special opportunity to save for retirement with tax-deferred earnings.

What is an IRA agreement?

An IRA Adoption Agreement and Plan Document is a contract between the owner of an IRA and the financial institution where the account is held. The IRA adoption agreement and plan document must be signed by the account owner before the individual retirement account (IRA) can be valid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA Restricted Account and Plan Repayment Agreement?

An IRA Restricted Account and Plan Repayment Agreement is a financial document that outlines the terms and conditions under which assets in an Individual Retirement Account (IRA) can be restricted or repaid, typically in the context of loans or withdrawals that are subject to specific regulations.

Who is required to file IRA Restricted Account and Plan Repayment Agreement?

Individuals who have taken loans against their Individual Retirement Accounts or who have executed a repayment plan related to IRS regulations regarding retirement funds are required to file this agreement.

How to fill out IRA Restricted Account and Plan Repayment Agreement?

To fill out the IRA Restricted Account and Plan Repayment Agreement, you need to provide personal identification information, details about the IRA, loan amount, repayment terms, and any additional documentation that supports the agreement's requirements.

What is the purpose of IRA Restricted Account and Plan Repayment Agreement?

The purpose of the IRA Restricted Account and Plan Repayment Agreement is to ensure compliance with IRS regulations regarding the use and repayment of funds from an IRA, thereby safeguarding the account holder's retirement savings.

What information must be reported on IRA Restricted Account and Plan Repayment Agreement?

The information that must be reported on the IRA Restricted Account and Plan Repayment Agreement includes the account holder's identification, the specifics of the IRA involved, the loan amount, repayment schedule, applicable interest rates, and signatures from both the lender and borrower.

Fill out your ira restricted account and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Restricted Account And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.