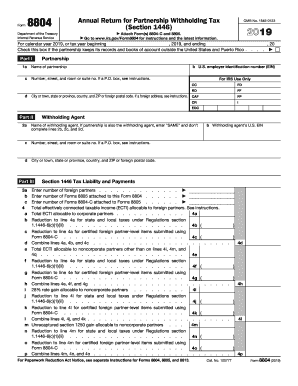

Annual Return for Partnership Withholding Tax

What's included in the Annual Return for Partnership Withholding Tax package

Did you know that it is possible to process your documents and forms in groups? From now on, any legal, tax, or other documents that you need to fill out are easily accessible within one package.

Now you can get all the forms required for filing for tax deduction, certification request, or other common purpose - all in one place, ready to submit and send immediately. Each deal features a selection of documents available in one place for your convenience. Change the structure of your document and edit its content using the PDF editor. There are various personalizing features accessible, all of them sorted into separate convenient toolbars according to the cases they serve. Once the document has been completed, click Done to save and proceed to the next document in the package.

There’s no reason to download or install anything. Carefully fill in all the required information in your form, attach your electronic signature, and click Done when you're ready to go.

pdfFiller saves you time and hassle with instant access to its robust selection of editing features and the largest online library of ready-to-use templates. Now, the document management and editing process are as fast and simple as never before. Streamline your perfect workflow and submit important documents accurately and efficiently.

Form 8804. ... Form 8804 is also a transmittal form for Forms 8805. Any additional withholding tax owed for the partnership's tax year is paid (in U. S. currency) with Form 8804. A Form 8805 for each foreign partner must be attached to Form 8804, whether or not any withholding tax was paid.

Form 8804-C is used by a foreign partner who chooses to provide to a partnership a certification under Regulations section 1.1446-6 to reduce or eliminate the partnership's withholding tax obligation under section 1446 (1446 tax) on the partner's allocable share of effectively connected taxable income (ECTI) from the ...

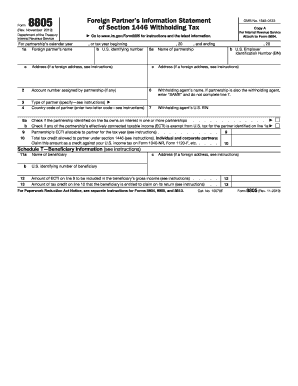

Form 8805, Foreign Partner's Information Statement of Section 1446 Withholding Tax. Form 8805 is used to show the amount of effectively connected taxable income and any withholding tax payments allocable to a foreign partner for the partnership's tax year.

Annual Return for Partnership Withholding Tax FAQs