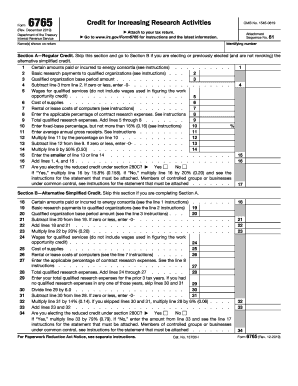

Credit for Increasing Research Activities

What's included in the Credit for Increasing Research Activities forms package

Get your paperwork done faster by managing documents in bulk. Use pdfFiller’s form bundles to simplify the process of submitting your forms and applications.

Browse the Credit for Increasing Research Activities package contents and select one of the documents to get started. pdfFiller is not only an extended document library but also a useful PDF editor, which allows to fill out and customize the template as much as you need. It features tools you can use to personalize the layout of document and make it look professional. Select any instrument to make the change you need, and click anywhere on the page.

There’s no reason to download or install anything. Carefully fill in all the required information in your form, add your electronic signature, and press Done when you're ready to go.

Now you have all required templates at hand, so you finally can save time and effort on document searching and sorting. Now, the document management and editing process are as fast and productive as never before. Improve your workflow and submit important forms accurately and efficiently.

Purpose of Form Use Form 6765 to figure and claim the credit for increasing research activities (research credit), to elect the reduced credit under section 280C, and to elect to claim a certain amount of the credit as a payroll tax credit against the employer portion of social security taxes.

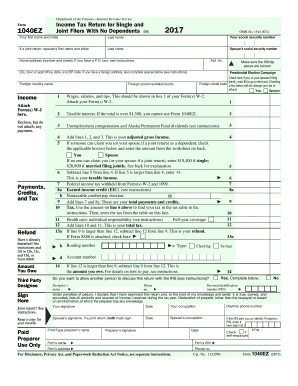

IRS Form 1040EZ: Income Tax Return for Single and Joint Filers with No Dependents was the shortened version of the Internal Revenue Service (IRS) Form 1040. This form was for taxpayers with basic tax situations and offered a fast and easy way to file income taxes.

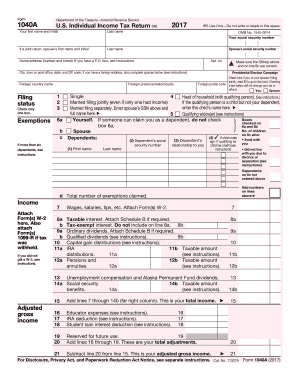

The IRS Form 1040A is one of three forms you can use to file your federal income tax return. ... All taxpayers can use Form 1040; however, to use Form 1040A you must satisfy a number of requirements, such as having taxable income of $100,000 or less and claiming the standard deduction rather than itemizing.

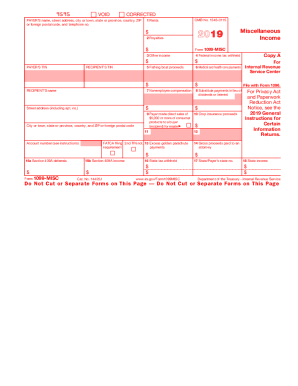

Introduction. The 1099 form is a series of documents the Internal Revenue Service (IRS) refers to as "information returns." There are a number of different 1099 forms that report the various types of income you may receive throughout the year other than the salary your employer pays you.

Credit for Increasing Research Activities FAQs