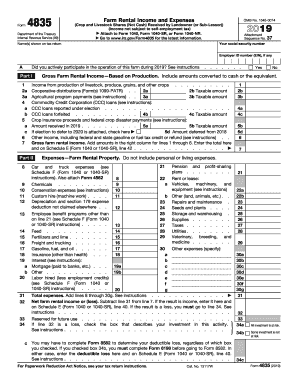

Farm Rental Income and Expenses

What's included in the Farm Rental Income and Expenses package

Obtain the Farm Rental Income and Expenses package by pdfFiller to add the documents mentioned to your workflow at once, and cut costs with special package deals. Now you have all templates you need at hand, so you finally can save time and hassle on document sorting and searching. You can also only the forms you need from the package, to cut the costs even more.

Forms from the pdfFiller bundles are picked to suit every particular occasion. Besides the Farm Rental Income and Expenses forms package, you can discover various packages classified by category, and proceed to completion right away. pdfFiller gives you a powerful document editing tool, electronic signatures, and complies with industry-leading standards for data protection.

To start working on the Farm Rental Income and Expenses forms package, click Fill Now on one of the forms. You will be instantly taken to the editing tool. Use the Wizard tool to make completion more efficient. They will guide you through the document, pointing out the information you need to fill in to complete the paper properly. Active areas are highlighted with white and marked with an arrow and hint message, so you will not miss it. After you finish a form, click Done and proceed with other forms from the deal.

Qualification for Form 4835 Form 4835 is the way for non-participating farmland owners to report their farm income and expenses.

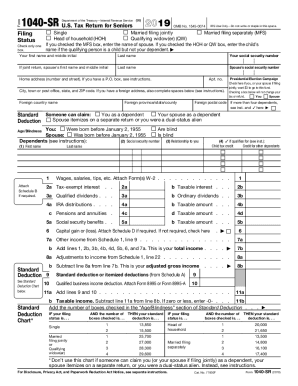

Form 1040NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from U.S. sources throughout the year.

Farm Rental Income and Expenses FAQs