FUTA Taxes for Household Employees

The documents you get with the FUTA Taxes for Household Employees forms package

Acquire the FUTA Taxes for Household Employees package by pdfFiller to add the documents in the above list to your paperwork immediately, and cut costs with special package deals. Save time on document searching and sorting - you now have all the forms you need accessible. It's also possible to deselect the forms you don't need from the package, to cut the costs even more.

Form packages in pdfFiller are manually categorized and contain the most popular paperwork cases such as tax submission, various applications, and agreements. The documents from the FUTA Taxes for Household Employees forms package and other deals have no limits for filling out and you can use them for numerous purposes. Effortlessly complete them in the full-featured editor, sign digitally, and stay compliant with industry-leading safety standards.

To start modifying the template, click Fill Now. Insert the information in the fillable fields. Use the Wizard tool so you don’t miss any important sections. It will highlight the required fields and parts of the template one after another, hinting the information you should insert. If you're not convenient with scanning the whole template trying to find missing fields on your own, use the list from the sidebar - it contains every piece of the form you should interact with. Repeat the same procedure with each form from the FUTA Taxes for Household Employees package and send them out all at once.

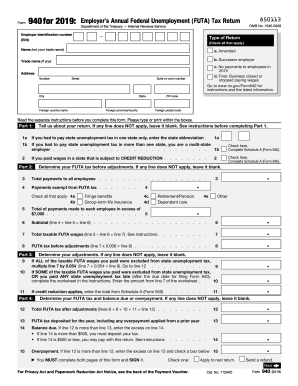

Use Form 940 to report your annual Federal Unemployment Tax Act (FUTA) tax. Together with state unemployment tax systems, the FUTA tax provides funds for paying unemployment compensation to workers who have lost their jobs. Most employers pay both a federal and a state unemployment tax. Only employers pay FUTA tax.

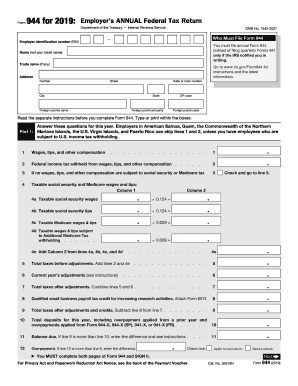

More In Forms and Instructions Employers use Form 941 to: Report income taxes, social security tax, or Medicare tax withheld from employee's paychecks. Pay the employer's portion of social security or Medicare tax.

A form an agricultural employer files with the IRS each year to report income and FICA taxes it withholds from its employees. The form lists federal income tax, Social Security and Medicare withholdings paid during the course of the year.

IRS Form 944 Explained IRS Form 944 is the Employer's Annual Federal Tax Return. The form was introduced by the IRS to give smaller employers a break in filing and paying federal income tax withheld from employees, as well Social Security and Medicare payments owed by employers and employees.

FUTA Taxes for Household Employees FAQs