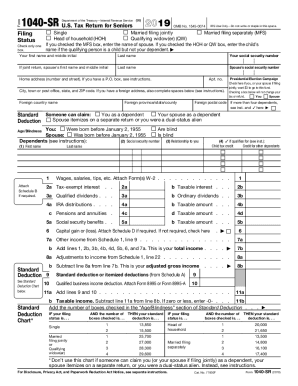

Premium Tax Credit (PTC)

The templates you get with the Premium Tax Credit (PTC) forms package

Get your paperwork done faster by managing documents in groups. Get the Premium Tax Credit (PTC) forms package by pdfFiller to simplify the process of submitting these forms, doing them at the same time.

Now you can get all the forms required for filing for tax deduction, certification request, or other common purpose - all in one place, ready to submit and share right away. Each package features a group of documents available in one place for your convenience. Use the PDF editing tool provided by pdfFiller to easily modify the content or structure of any of the documents included in the package. Depending on what operation you wish to cover, pdfFiller features separate toolbars with a range of editing tools. Once the document has been completed, click Done to save and proceed to the next document in the bundle.

pdfFiller’s form bundles allow to reduce the amount of time it takes to submit an application, complete a tax form, sign a contract, and so on. pdfFiller is a robust, web-based document management platform that features an array of onboard editing features. Don't go another day to find your submissions rejected due to improper formatting or a single not completed form - get the Premium Tax Credit (PTC) forms package, fill out with the required information, put a digital signature and send, all within a single platform.

Key Takeaways. Form 8962 is used to estimate the amount of premium tax credit for which you're eligible if you're insured through the Marketplace. You only need to complete Form 8962 if you received advance payments of premium tax credits for health insurance premiums paid.

Form 1040NR is a version of the IRS income tax return that nonresident aliens may have to file if they engaged in business in the United States during the tax year or otherwise earned income from U.S. sources throughout the year.

Premium Tax Credit (PTC) FAQs