Quarterly tax return forms package

Purchase the Quarterly tax return package to get these templates

Try pdfFiller’s Quarterly tax return forms package to fill out and submit entire document groups at once. Save time searching and sorting documents - now you have all the necessary forms accessible. It's also possible to use one or several templates from the package.

Forms for pdfFiller bundles are carefully picked to suit every particular occasion. Here, you can find template packages by category, ensure you get the documents you need, and quickly and accurately submit them. pdfFiller provides you with a powerful PDF document editor, electronic signatures, and complies with industry-leading standards for data protection.

Click Fill Now to start working on your form using the full-featured editor. Enter the information in the fillable fields marked as required. Follow the Wizard tool's guidelines to know what steps you ought to take to do the filling out procedure as meant. The arrows will guide you through the document, showing which field is active, and the cues will tell you which information to enter. Also, take advantage of the field list to ensure that all of them are completed. Repeat the same procedure with each form in the Quarterly tax return package and send them out simultaneously.

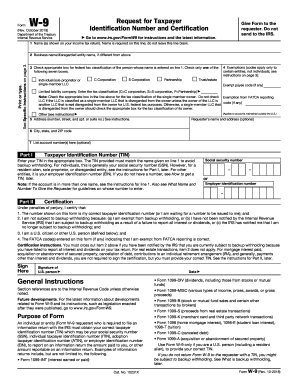

Form W-9 is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service. It requests the name, address, and taxpayer identification information of a taxpayer.

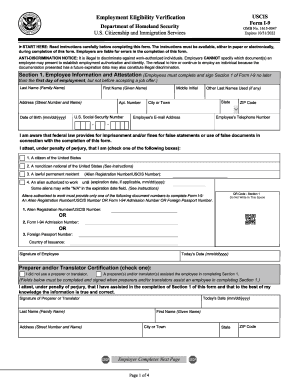

Form I-9, officially the Employment Eligibility Verification, is a United States Citizenship and Immigration Services form. Mandated by the Immigration Reform and Control Act of 1986, it is used to verify the identity and legal authorization to work of all paid employees in the United States.

If you've received money from another sole proprietor or company, you'll definitely receive IRS form W-9 to complete. This form is a Request for Taxpayer Identification Number (TIN). It is sent by the HR managers of large companies or individuals to their employees who received payments for services provided.

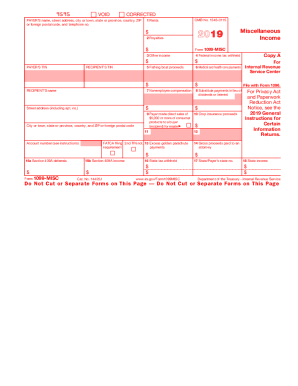

File Form 1099-MISC for each person to whom you have paid during the year: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

Quarterly tax return forms package FAQs