Support Under Section 213A of the INA

Purchase the Support Under Section 213A of the INA forms package to get these documents

Fill out and share the Support Under Section 213A of the INA package online using pdfFiller. From now on, you don’t have to search for each form separately to organize them - they’re compiled in one place to save you time.You can also opt out the templates you won't need if it's the case.

pdfFiller gets you covered with bundles for every occasion. Besides the Support Under Section 213A of the INA package, you can get a great number of bundles classified by category, and file them. pdfFiller gives you a powerful document editing tool, legally-binding e-signatures, and complies with industry-leading security standards.

To start editing the template, click Fill Now. Enter your information in the fillable fields marked as required. Follow the Wizard tool's instructions to know what steps you should take to do the completion process as planned. It highlights the required fields and parts of the template one after another, cueing the information you should insert. If you're not convenient with scanning the whole template trying to find missing fields on your own, use the list from the pane above - it contains every piece of the form you should interact with. Repeat the same procedure with each form from the Support Under Section 213A of the INA package and send them out all at once.

Form I-864, Affidavit of Support, is required for most family-based immigrants and some employment-based intending immigrants to show that they have adequate means of financial support and are not likely to become a public charge. It's a contract between a sponsor and the U.S. government.

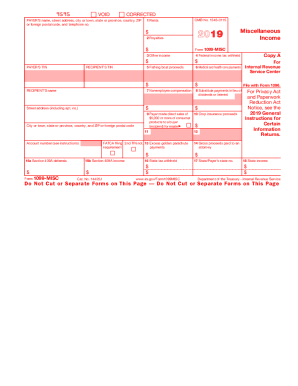

File this form to report gambling winnings and any federal income tax withheld on those winnings. ... the type of gambling, the amount of the gambling winnings, and. generally the ratio of the winnings to the wager.

Use Schedule D (Form 1040 or 1040-SR) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

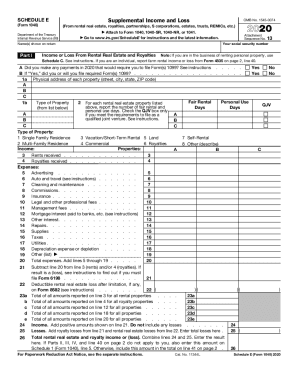

Use Schedule E (Form 1040 or 1040-SR) to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits (REMICs).

Form I-864A, Contract Between Sponsor and Household Member, is an attachment to Form I-864, Affidavit of Support Under Section 213A of the INA. A separate Form I-864A must be used for each household member whose income and/or assets are being used by a sponsor to qualify.

Form I-551 or the U.S. Permanent Resident card (also known as a Green Card) proves that foreign nationals have been approved for permanent residency in the United States.

Support Under Section 213A of the INA FAQs