What are 2011 Forms?

2011 Forms are a series of tax forms used by individuals, businesses, and organizations to report financial information to the IRS for the year 2011.

What are the types of 2011 Forms?

There are various types of 2011 Forms depending on the type of income or transaction being reported. Some common types include:

2011 Form Individual Income Tax Return

2011 Form Miscellaneous Income

2011 Form Corporation Income Tax Return

2011 Form Employer's Quarterly Federal Tax Return

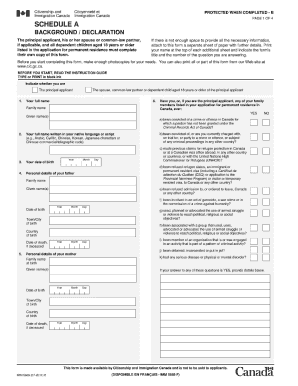

How to complete 2011 Forms

Completing 2011 Forms can be a straightforward process if you follow these simple steps:

01

Gather all necessary financial information for the year 2011.

02

Carefully read the instructions provided for each specific form.

03

Fill in the required fields accurately and double-check all information for accuracy before submitting.

04

If needed, consult with a tax professional for assistance or clarification on any sections of the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2011 Forms

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 2210 form?

Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

How do I get my 2011 tax return?

Complete Form 4506, Request for Copy of Tax Return, and mail it to the IRS address listed on the form for your area. Copies are generally available for the current year as well as the past six years. Please allow 60 days for actual copies of your return.

What is a form 11 tax form?

The IRS Form 11-C is used to register certain information with the Internal Revenue Service (IRS) and is used in order to pay the occupational tax on wagering. An individual should pay the occupational tax if the individual accepts taxable wagers for themselves or another person.

Who should file form 2210?

You may need this form if: You're self-employed or have other income that isn't subject to withholding, such as investment income. You don't make estimated tax payments or paid too little. You don't have enough taxes withheld from your paycheck.

What triggers IRS underpayment penalty?

The Underpayment of Estimated Tax by Individuals Penalty applies to individuals, estates and trusts if you don't pay enough estimated tax on your income or you pay it late. The penalty may apply even if we owe you a refund. Find how to figure and pay estimated tax.

How do you avoid penalty 2210?

Waiver of Penalty In 2021 or 2022, you retired after reaching age 62 or became disabled, and your underpayment was due to reasonable cause (and not willful neglect). or. The underpayment was due to a casualty, disaster, or other unusual circumstance, and it would be inequitable to impose the penalty.

Related templates