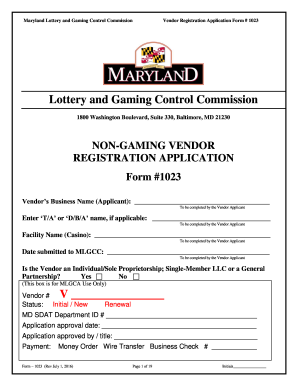

1023 Form

What is 1023 form?

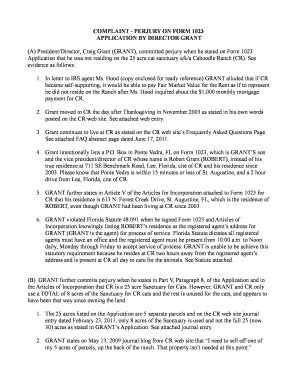

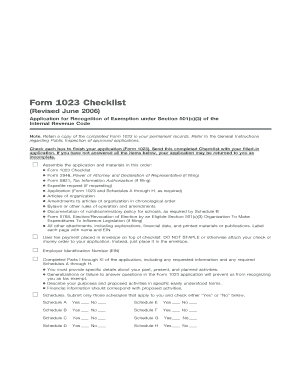

The 1023 form, also known as the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, is a crucial document for organizations seeking tax-exempt status in the United States. By completing this form, nonprofit organizations can apply for recognition of exemption from federal income tax.

What are the types of 1023 form?

There are two main types of 1023 forms: Form 1023 and Form 1023-EZ. 1. Form 1023: This is the standard and more comprehensive form, applicable to most organizations seeking tax-exempt status. It requires in-depth information about the organization's activities, finances, governance, and more. 2. Form 1023-EZ: This is a simplified version of the form, designed for smaller organizations with less than $50,000 in annual gross receipts and total assets. It requires less documentation and has a shorter processing time.

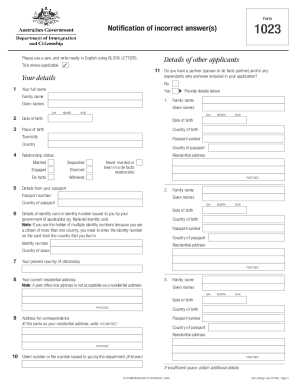

How to complete 1023 form

Completing the 1023 form correctly is essential to ensure a smooth application process for tax-exempt status. Here is a step-by-step guide to help you fill out the form accurately:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.