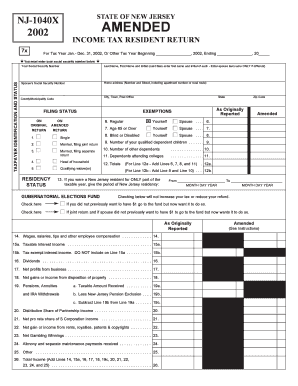

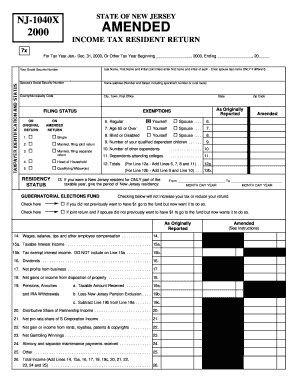

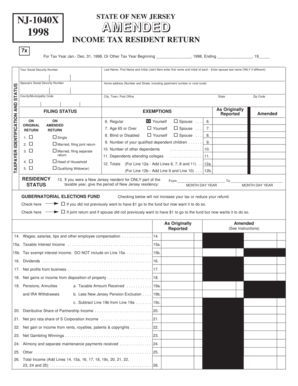

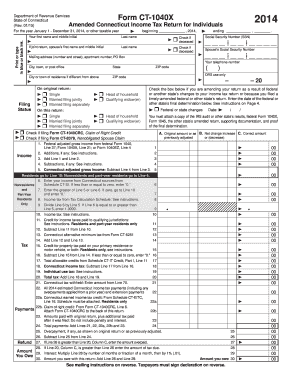

1040x Status

What is 1040x status?

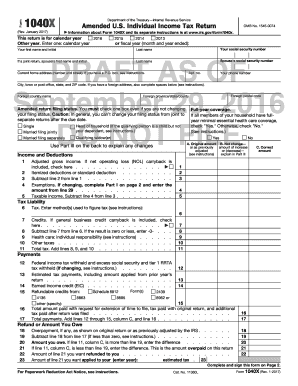

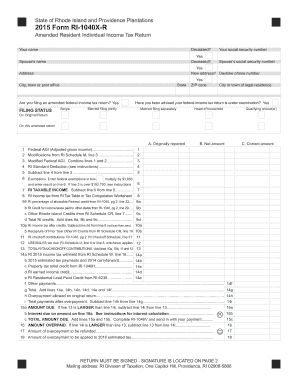

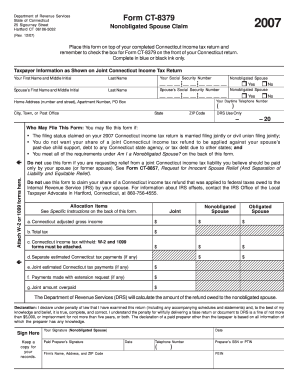

The 1040x status refers to an amended tax return filed by individuals who have already submitted their original Form 1040 but need to make changes or corrections. It is used to rectify mistakes or update previously reported information.

What are the types of 1040x status?

There are several types of 1040x status that individuals can encounter when amending their tax returns. These include:

Change in filing status

Correction in income or deduction amounts

Adjustment to tax credits or payments

Adding or removing dependents

Modifying previously claimed exemptions

How to complete 1040x status

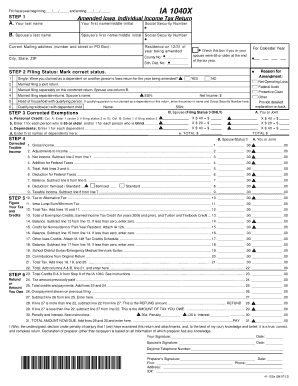

Completing the 1040x status requires a few steps to ensure accuracy and completeness. Here is a straightforward guide:

01

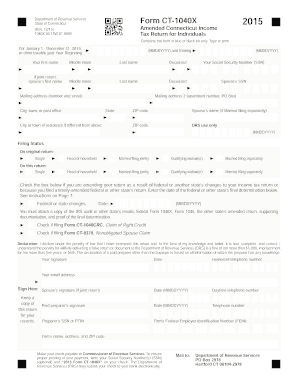

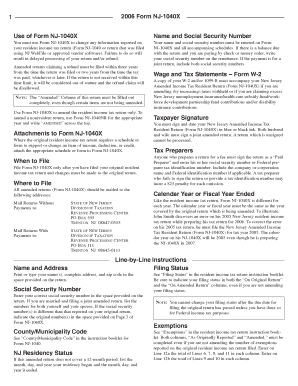

Download Form 1040x from the IRS website or use a reliable tax software.

02

Provide your basic information, including name, social security number, and tax year.

03

Indicate the changes you are making by filling out the appropriate sections of the form.

04

Include any supporting documentation required to justify the changes.

05

Double-check all the entries and calculations to avoid errors.

06

Sign and date the completed form.

07

Submit the 1040x by mail to the appropriate IRS address.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1040x status

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

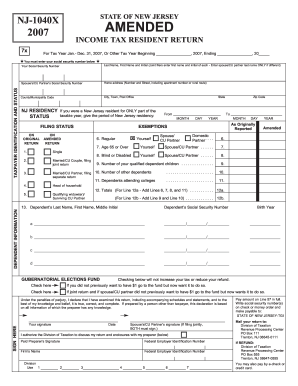

What should I include with amended 1040X?

When filing an amended or corrected return: Include copies of any forms and/or schedules that you're changing or didn't include with your original return. To avoid delays, file Form 1040-X only after you've filed your original return.

What is a common reason for filing a 1040X?

Form 1040x is the tax form you use if you need to correct a previously filed federal income tax return. Some common reasons you may need to amend your return include: You forgot to claim a tax deduction or income tax credit. You need to change your filing status or add or remove a dependent.

Can I file an amended tax return to change filing status?

The IRS may correct mathematical, clerical errors on a return and may accept returns without certain required forms or schedules. In these instances, there's no need to amend your return. However, do file an amended return if there's a change in your filing status, income, deductions, credits or tax liability.

Can IRS Form 1040X be filed electronically?

Can I file my Amended Return electronically? If you need to amend your 2019, 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X, Amended U.S. Individual Income Tax Return electronically using available tax software products.

How do I change my marital status with the IRS?

Use Form 1040-X to change your filing status. Separate returns after joint return. After the due date of your return, you and your spouse can't file separate returns if you previously filed a joint return.

Are amended returns processed electronically?

The IRS is—finally—making more amended returns available for taxpayers to file electronically. For years, all amended returns had to be filed by paper.

Related templates