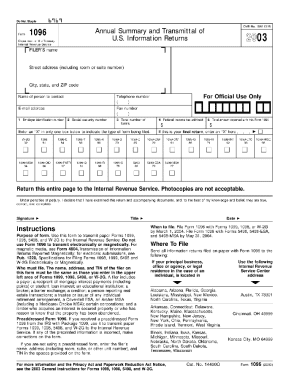

1096 Form 2013

What is 1096 Form 2013?

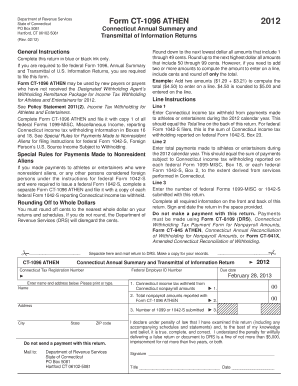

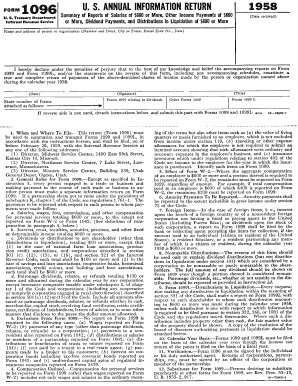

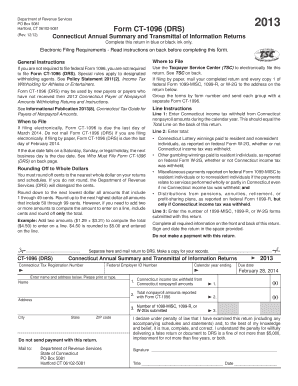

The 1096 Form 2013 is an IRS form used to summarize and transmit information returns like 1099, 1098, and W-2G to the IRS. It acts as a cover sheet for these forms, providing totals for each type of form being submitted.

What are the types of 1096 Form 2013?

The types of 1096 Form 2013 include:

1099-MISC

1099-INT

1099-DIV

1099-R

1099-K

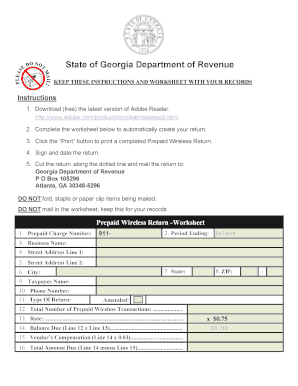

How to complete 1096 Form 2013

To complete the 1096 Form 2013, follow these steps:

01

Fill in the top section with your information, such as name, address, and TIN.

02

Enter the total number of forms being submitted for each type in the appropriate boxes.

03

Summarize the totals of all information returns being submitted.

04

Sign and date the form before submitting it to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 1096 Form 2013

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can Form 1096 be filed electronically?

More In Forms and Instructions Use Form 1096 to transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service. Do not use this form to transmit electronically.

Can you fill out Form 1096 by hand?

A: Yes, it is permissible to submit handwritten forms. Not clear on your question about it being scannable. Are you asking if you can scan one and reprint however many you need? The answer on the 1096 is NO.

Does Form 1096 have to be filed electronically?

Remember that the IRS treats every version of Form 1099 as a separate type of form, and that there are 16 different versions of Form 1099. Also keep in mind that if you need to submit 250 or more copies of Form 1096, you must file electronically. Failing to do so could result in a penalty from the IRS.

Can I download a 1096 form?

1096 tax forms can't be downloaded from the IRS website, because they have to be in a scannable format and contain fields that the IRS uses to track compliance with entity and payee form submissions. Additionally, 1096 tax forms are only available for paper submissions and not an electronic tax return.

Can I fill out 1099 1096 by hand?

Yes, you can handwrite a 1099 or W2, but be very cautious when doing so. The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors.

Can I hand write Form 1096?

A: Yes, it is permissible to submit handwritten forms.

Related templates