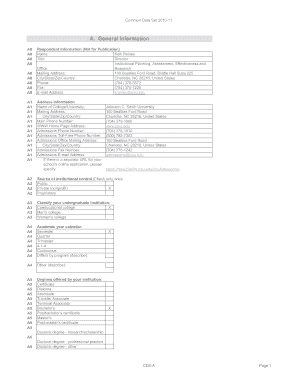

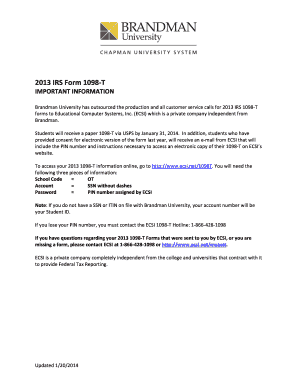

1098 Form 2013

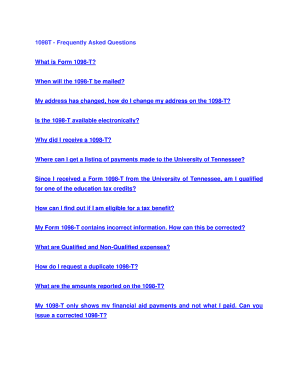

What is 1098 Form 2013?

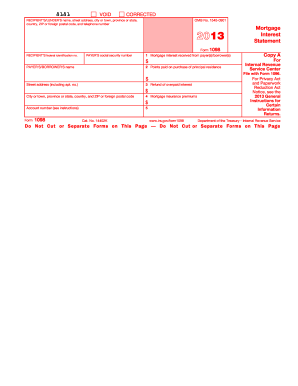

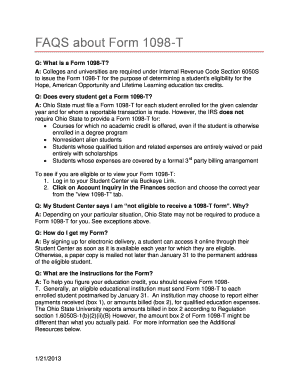

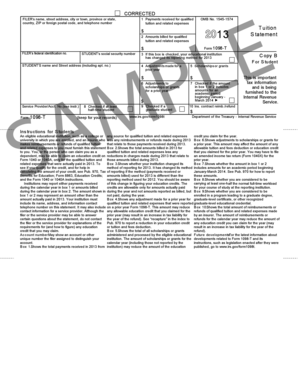

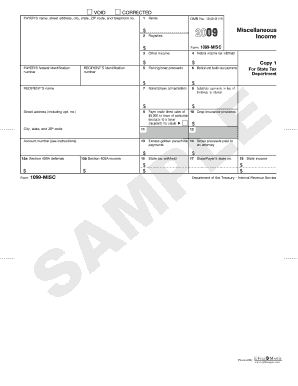

The 1098 Form 2013 is a tax form used to report mortgage interest received by an individual or entity during the specified tax year. It is primarily used by homeowners who have paid mortgage interest to a financial institution or mortgage lender. This form is important for both the taxpayer and the Internal Revenue Service (IRS) to accurately calculate and report the deductible mortgage interest expenses.

What are the types of 1098 Form 2013?

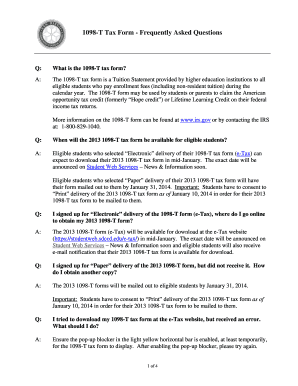

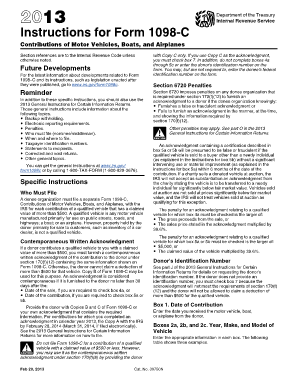

There are three types of 1098 Form 2013 that are commonly used: 1. Form 1098: Mortgage Interest Statement - This form is used to report the mortgage interest received by an individual or entity, such as a homeowner. 2. Form 1098-C: Contributions of Motor Vehicles, Boats, and Airplanes - This form is used to report charitable contributions of motor vehicles, boats, and airplanes if certain conditions are met. 3. Form 1098-E: Student Loan Interest Statement - This form is used to report the student loan interest received by an individual or entity.

How to complete 1098 Form 2013

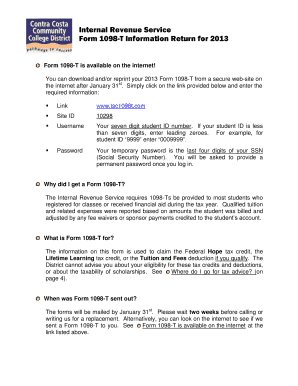

Completing the 1098 Form 2013 is a straightforward process. Here are the steps to follow: 1. Obtain a copy of the 1098 Form 2013 from the IRS website or a tax preparation software. 2. Fill in your personal information, including your name, address, and taxpayer identification number. 3. Enter the mortgage interest received in the specified boxes. Make sure to accurately input the amounts as failing to do so may result in discrepancies with the IRS. 4. If applicable, fill in any additional required information specific to the type of 1098 Form you are completing. 5. Double-check all the information you have entered to ensure accuracy. 6. Sign and date the form before submitting it to the IRS along with your tax return.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.