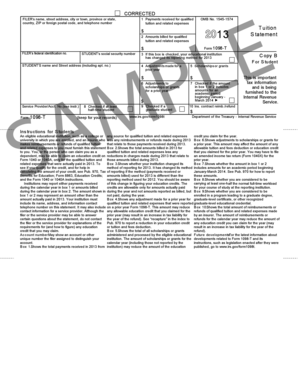

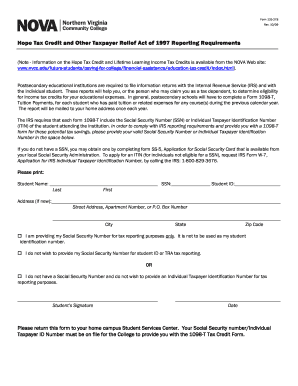

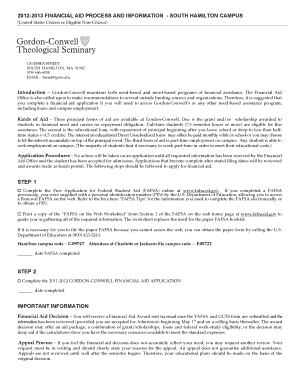

1098-t Form 2013

Video Tutorial How to Fill Out 1098-t Form 2013

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

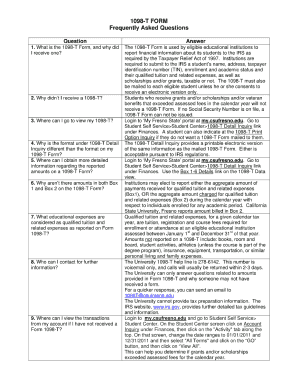

Questions & answers

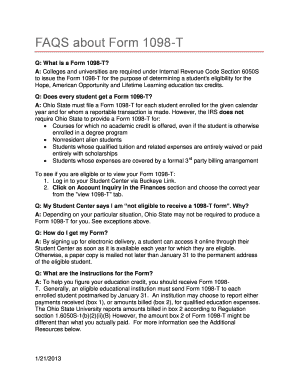

How far back can you file 1098-T?

You can file form1098-T for more than four years. However, after the first four years the most beneficial education credit (the American Opportunity Credit) will be used up. After that, you'll be able claim the Lifetime Learning Credit or the Tuition and Fees Deduction.

How do I get my 1098-T from previous years?

If I have not received a Form 1098-T to complete my taxes, is there a way I can obtain one? Questions concerning Internal Revenue Service (IRS) forms and filing requirements should be directed to the IRS. You can contact the IRS via telephone at 1-800-829-1040 or find further information online at: IRS.gov.

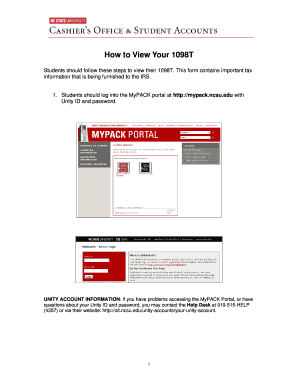

How do I access my old 1098-T?

What do I need to do? You can access your 1098-T form by visiting the Tab Service 1098t website. UC has contracted with Tab Service to electronically produce your 1098-T form. *The Site ID will be provided by your campus.

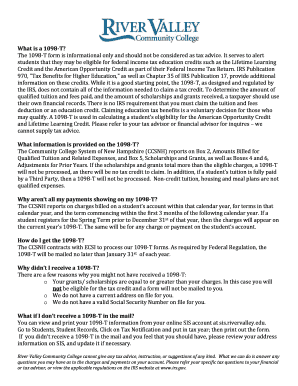

Can you skip 1098-T?

Yes, you CAN file your tax return without the 1098-T information. However, it may not be in your best interest to do so. Entering in the 1098-T data will enable you to find out if you qualify for certain higher education credits (ex: American Opportunity Tax Credit and the Lifetime Learning Credit).

How does a 1098-T affect my tax return?

The Form 1098-T is a form provided to you and the IRS by an eligible educational institution that reports, among other things, amounts paid for qualified tuition and related expenses. The form may be useful in calculating the amount of the allowable education tax credits.

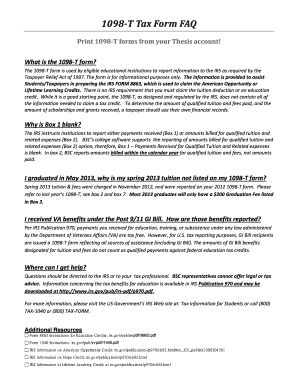

How do I enter a 1098-T?

If you received a 1098-T and you weren't reimbursed by your employer, you can enter that info in the mobile app. Open the app and sign in. Select Deductions & Credits then Review/Edit. Choose Education then Expenses and Scholarships (Form 1098-T). Follow the instructions to enter your expenses.

Related templates