1099-misc Form 2012

What is 1099-misc Form 2012?

The 1099-misc Form 2012 is a tax form used by businesses and freelancers to report miscellaneous income earned throughout the year. It is one of the many forms provided by the Internal Revenue Service (IRS) to ensure accurate reporting of income and to assist in calculating taxes owed or refunds due. The 1099-misc Form 2012 is specifically designed for the tax year 2012, and is used to report income earned during that period.

What are the types of 1099-misc Form 2012?

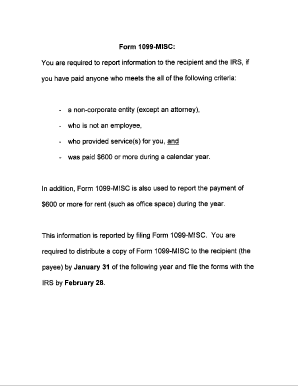

The 1099-misc Form 2012 has various types that cover different types of income. Some of the common types of 1099-misc Form 2012 include: 1. Box 1 - Rents 2. Box 2 - Royalties 3. Box 3 - Other Income 4. Box 4 - Federal Income Tax Withheld 5. Box 5 - Fishing Boat Proceeds 6. Box 6 - Medical and Health Care Payments 7. Box 7 - Nonemployee Compensation These are just a few examples, and there may be additional types depending on the specific circumstances of the individual or business.

How to complete 1099-misc Form 2012

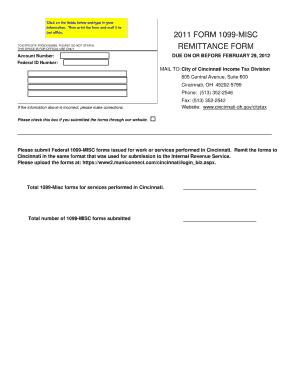

Completing the 1099-misc Form 2012 is a straightforward process. Here are the steps to follow: 1. Obtain the 1099-misc Form 2012 from the IRS website or other trusted sources. 2. Fill in your personal or business information, including name, address, and taxpayer identification number. 3. Determine the type of income being reported and enter the corresponding amount in the appropriate boxes. 4. If applicable, fill in any federal income tax withheld in Box 4. 5. Double-check all the information entered to ensure accuracy. 6. Sign and date the form. 7. Keep a copy for your records and send the completed form to the appropriate recipients and the IRS as instructed. Remember, accuracy is crucial when completing tax forms, so make sure to review the instructions provided by the IRS or seek professional advice if needed.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.