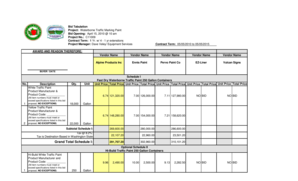

12 Month Cash Flow Forecast

What is 12 month cash flow forecast?

A 12 month cash flow forecast is a financial projection that predicts the inflows and outflows of cash in a business over a period of 12 months. It provides valuable insights into a company's financial health and helps in making informed decisions regarding budget allocation, investment planning, and identifying potential cash shortages or surpluses. By forecasting the expected cash flow, businesses can effectively manage their finances and ensure optimum cash flow management.

What are the types of 12 month cash flow forecast?

There are different types of 12 month cash flow forecasting methods that businesses can use, depending on their specific needs and requirements. Some common types are: 1. Direct Cash Flow Forecast: This method involves estimating cash inflows and outflows based on historical data and expected payments and receipts. 2. Indirect Cash Flow Forecast: This method uses accounting figures such as net income, depreciation, and changes in working capital to forecast cash flow. 3. Rolling Cash Flow Forecast: This method involves regularly updating the cash flow forecast based on the most recent data and adjusting the projections for the upcoming months.

How to complete 12 month cash flow forecast

Completing a 12 month cash flow forecast requires careful analysis and planning. Here are the steps you can follow:

With pdfFiller, completing a 12 month cash flow forecast becomes even easier. Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. By utilizing the features provided by pdfFiller, users can conveniently and confidently complete their 12 month cash flow forecast with efficiency and accuracy.