2012 540 Form - Page 2

What is 2012 540 Form?

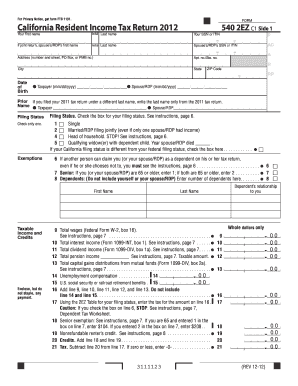

The 2012 540 Form is a tax form used by individuals in the state of California to report their income and calculate their tax liability for the year 2012. It is specifically designed for residents of California who need to file their state income tax return.

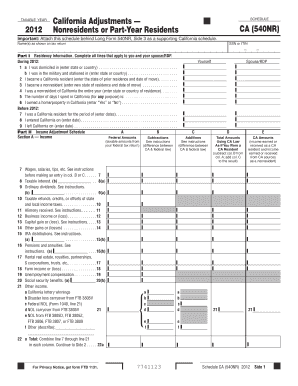

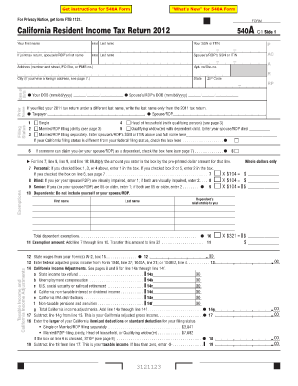

What are the types of 2012 540 Form?

There are three main types of 2012 540 Form:

Form 540

Form 540A

Form 540EZ

How to complete 2012 540 Form

Completing the 2012 540 Form is a straightforward process. Here are the steps to follow:

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any other relevant tax documents.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Report your income for the year 2012 in the appropriate sections of the form.

04

Calculate your deductions and exemptions to determine your taxable income.

05

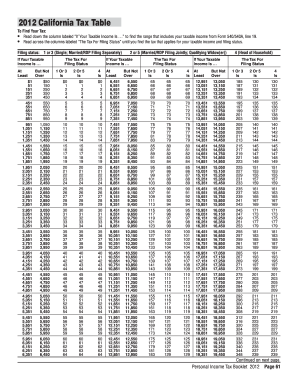

Use the provided tax tables or the online tax calculator to calculate your tax liability.

06

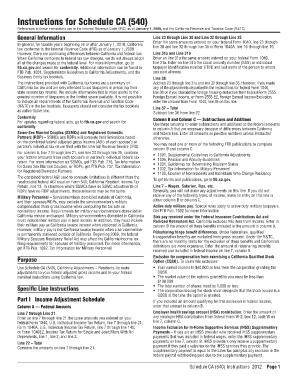

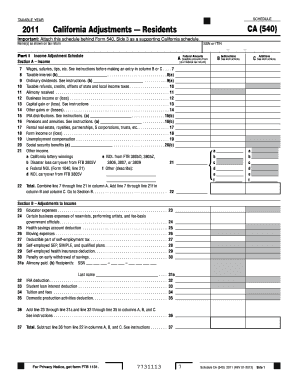

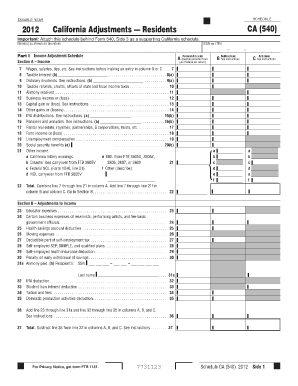

Complete any additional sections or schedules that apply to your specific situation.

07

Review your completed form for accuracy and make any necessary corrections.

08

Sign and date the form before submitting it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2012 540 Form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is form 540 the same as 1040?

What is Form 540? Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

Can you buy tax forms?

You can order the tax forms, instructions and publications you need to complete your 2021 tax return here. We will process your order and ship it by U.S. mail when the products become available. Most products should be available by the end of January 2022.

Where can I get California state tax forms?

Where Do I Find California Tax Forms? If you are trying to locate, download, or print California tax forms, you can do so on the state of California Franchise Tax Board website, found at https://www.ftb.ca.gov/forms/.

Can I file CA 540 online?

Accepted forms Forms you can e-file for an individual: California Resident Income Tax Return (Form 540) California Resident Income Tax Return (Form 540 2EZ) California Nonresident or Part-Year Resident Income Tax Return (Form 540NR)

Where do I file form 540 in California?

Personal FormWithout paymentWith payment540 540 2EZ 540NR Schedule XFranchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001540 (Scannable)Franchise Tax Board PO Box 942840 Sacramento CA 94240-0001Franchise Tax Board PO Box 942867 Sacramento CA 94267-0001 Sept 22, 2021

How do I file form 540?

When filing Form 540, you must send all five sides to the Franchise Tax Board (FTB). Use black or blue ink on the tax return you send to the FTB. Enter your social security number(s) (SSN) or individual taxpayer identification number(s) (ITIN) at the top of Form 540, Side 1.

Related templates