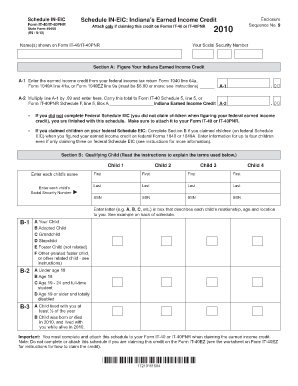

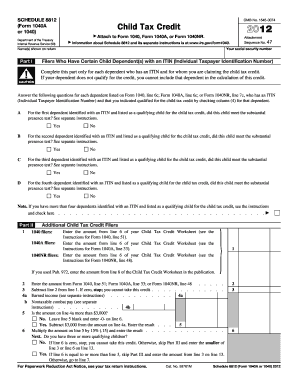

2012 Form 1040 Instructions

Video Tutorial How to Fill Out 2012 form 1040 instructions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Where can I get 1040 instructions?

See IRS.gov and IRS.gov/Forms, and for the latest information about developments related to Forms 1040 and 1040-SR and their instructions, such as legislation enacted after they were published, go to IRS.gov/Form1040.

How do I file old tax returns Canada?

You can submit a late tax return using the same methods you would use to file your return on time. You can turn in your taxes using tax preparation software, mailing a return prepared by a tax preparer, or completing the CRA's General Income Tax and Benefit Package and submitting it through the mail.

How do I file a 1040 step by step?

How to Fill Out Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information, and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

Can I still file my 2012 taxes electronically?

2012 Federal Income Tax Forms. You can no longer e-File a 2012 Federal or State Tax Return. Mail-in instructions are below.

How many years back can I file my taxes in Canada?

How far back can you go to file taxes in Canada? According to the CRA, a taxpayer has 10 years from the end of a calendar year to file an income tax return. The longer you go without filing taxes, the higher the penalties and potential prison term.

Can I still file my 2012 tax return?

Note: If filing for a tax refund the time to file a 2012 tax return has expired. To file a 2012 tax return for a tax refund had to be filed on or before April 15, 2016.

Related templates