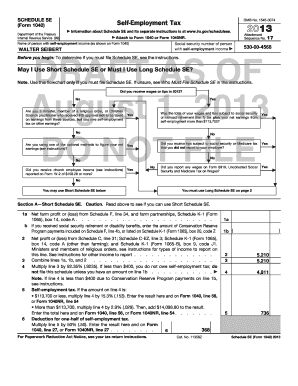

2012 Schedule Se

What is 2012 schedule se?

The 2012 schedule se, also known as the Schedule SE, is a form used by self-employed individuals to report their earnings and calculate self-employment tax. It is an important document that helps determine the amount of Social Security and Medicare taxes a self-employed person owes.

What are the types of 2012 schedule se?

There are two types of 2012 schedule se forms: 1. Schedule SE (Form 1040), which is used by self-employed individuals who file their taxes using Form 1040. 2. Schedule SE (Form 1040-SR), which is used by self-employed individuals who file their taxes using Form 1040-SR, specifically designed for senior taxpayers.

How to complete 2012 schedule se

Completing the 2012 schedule se is a straightforward process. Here are the steps to follow: 1. Obtain the 2012 schedule se form from the IRS website or a reputable tax preparation software. 2. Fill out the necessary personal information, including your name, Social Security number, and filing status. 3. Calculate your net profit or loss from your self-employment activities. 4. Determine the amount of self-employment tax you owe by multiplying your net profit by the self-employment tax rate. 5. Fill in the required fields on the form to report your self-employment tax correctly. 6. Double-check all the information provided and ensure the form is signed and dated. 7. Submit the completed 2012 schedule se along with your tax return and any other required documentation.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.