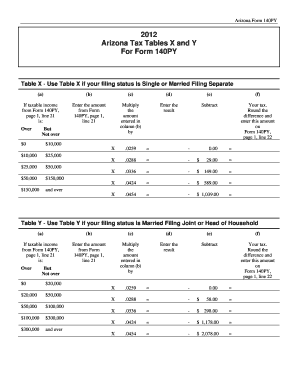

2012 Tax Tables

What is 2012 tax tables?

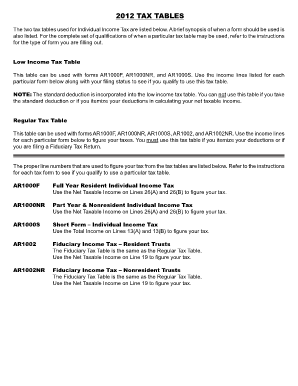

A 2012 tax table is a chart or schedule that outlines the tax rates and corresponding tax amounts for different income levels in the year 2012. It provides taxpayers with a clear understanding of how much they owe in taxes based on their income. The 2012 tax tables are used by individuals and businesses to calculate their tax liability and ensure accurate payment.

What are the types of 2012 tax tables?

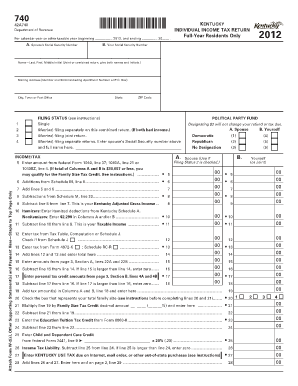

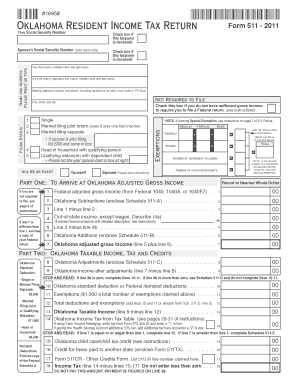

There are different types of 2012 tax tables based on the filing status of the taxpayer. These include: 1. Single filers 2. Married individuals filing jointly 3. Married individuals filing separately 4. Head of household 5. Qualifying widow(er) with dependent child Each type of tax table is specific to the particular filing status and provides the tax rates and brackets applicable to that status.

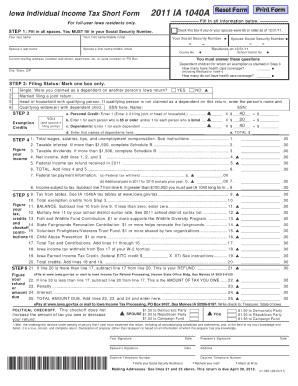

How to complete 2012 tax tables

Completing 2012 tax tables is a straightforward process that requires the following steps: 1. Gather all necessary income-related documents, such as W-2s, 1099s, and any other relevant forms. 2. Determine your filing status based on your marital status and household situation. 3. Use the appropriate 2012 tax table for your filing status to find your taxable income range and corresponding tax rate. 4. Calculate your tax liability by applying the tax rate to your taxable income. 5. Subtract any applicable deductions or credits to determine your final tax owed or refund due. 6. Fill out the relevant sections on your tax return form with the calculated tax amount. 7. Double-check all information for accuracy and completeness. 8. Sign and date your tax return before submitting it to the appropriate tax authority.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.