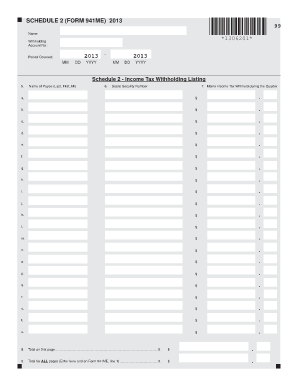

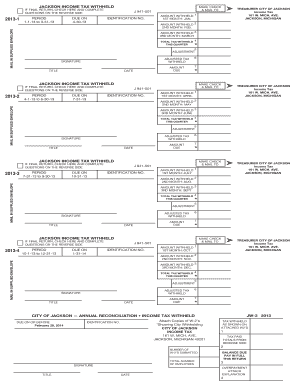

2013 Form 941

What is 2013 Form 941?

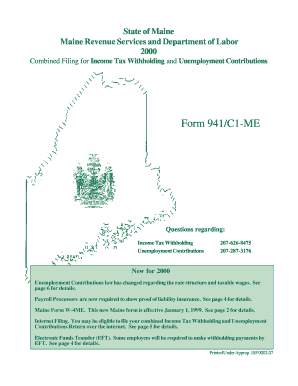

The 2013 Form 941 is a tax form used by employers to report employment taxes to the Internal Revenue Service (IRS). It is specifically designed for businesses with employees, including those who withhold federal income tax, Social Security taxes, and Medicare taxes from their employees' wages.

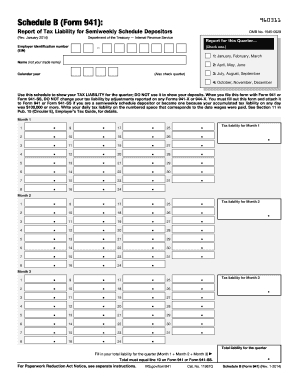

What are the types of 2013 Form 941?

There are several types of 2013 Form 941, depending on the specific situation of the employer. The common types include:

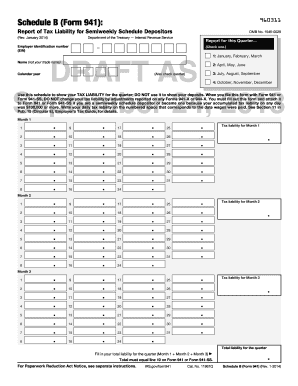

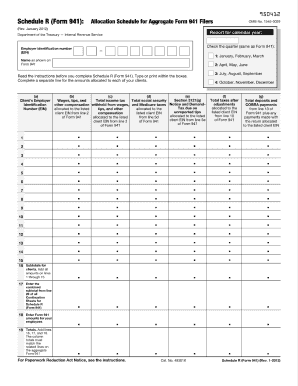

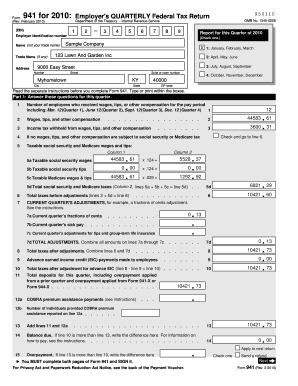

Form 941 - Employer's Quarterly Federal Tax Return

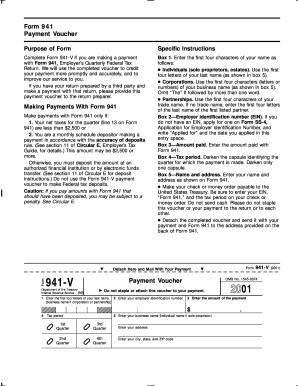

Form 941-V - Payment Voucher

Form 941-SS - Employer's Quarterly Federal Tax Return - American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands

Form 941-PR - Planilla para la Declaración de la Contribución Federal del Patrono

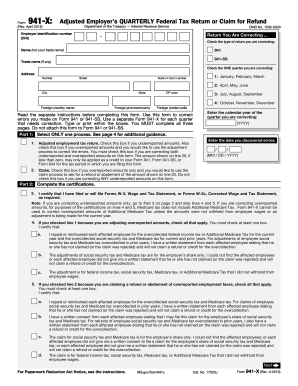

Form 941-X - Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

How to complete 2013 Form 941

Completing the 2013 Form 941 involves several steps to ensure accurate reporting. Below are the general instructions:

01

Provide your contact information, including the employer's name, address, and EIN (Employer Identification Number).

02

Enter the number of employees for the selected quarter.

03

Report the total wages, tips, and other compensation paid to employees during the quarter.

04

Calculate the withheld federal income tax, Social Security tax, and Medicare tax.

05

Determine if any adjustments need to be made to the reported amounts and complete the necessary sections accordingly.

06

Sign and date the form to certify its accuracy.

07

Keep a copy for your records and submit the form to the IRS.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2013 Form 941

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can you file form 941 late?

Late Filing Deposits made between six and 15 days late have a five percent penalty and a ten percent penalty for deposits more than 16 days late, plus interest. If you file Form 941 late, the IRS imposes a penalty of five percent per month or partial month you are late, up to a maximum of 25 percent.

Who can prepare Form 941?

To submit the form Business taxpayers can access e-File through most tax preparation software for small businesses. Your accountant or tax professional should also have access to e-File. You can also mail Form 941.

How much does it cost to efile 941?

940 / 941 / 943 / 944 / 945 Forms Forms 940, 941, 943, 944, 945No. of Forms Price per form or (SCH R)linePricingFirst Form$4.95Next 3 Forms$4.455-25 Forms$3.953 more rows

Do I have to file 941 electronically?

This federal tax return must be filed every quarter, enabling the IRS to understand and assess the employer's track of federal tax payments and filings. Form 941 can be filed electronically and by paper.

How do I submit form 941?

The fastest way to file Form 941 is through the federal e-File system. Business taxpayers can access e-File through most tax preparation software for small businesses. Your accountant or tax professional should also have access to e-File.

What happens if you forget to file 941?

If you fail to File your Form 941 or Form 944 by the deadline: Your business will incur a penalty of 5% of the total tax amount due. You will continue to be charged an additional 5% each month the return is not submitted to the IRS up to 5 months.

Related templates