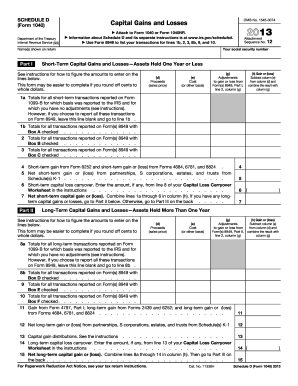

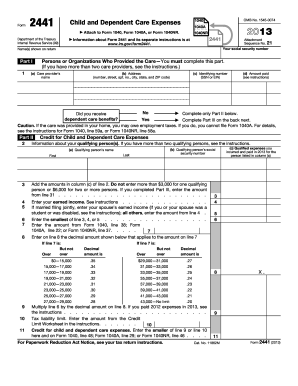

2013 Tax Form 1040

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I get my tax forms from previous years?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.

How do I get an old IRS Form 1040?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

How do I get a copy of last years 1040?

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Can you get old copies of tax returns from IRS?

Prior year tax returns are available from the IRS for a fee. Taxpayers can request a copy of a tax return by completing and mailing Form 4506 to the IRS address listed on the form. There's a $43 fee for each copy and these are available for the current tax year and up to seven years prior.

Where can I find all my tax documents?

Get a Transcript of a Tax Return Online - To read, print, or download your transcript online, you'll need to register at IRS.gov. To sign-up, create an account with a username and a password. By mail - To get a transcript delivered by postal mail, submit your request online.

How can I get a copy of my 2013 tax return from the IRS?

You can also order tax return and account transcripts by calling 800-908-9946 and following the prompts in the recorded message, or by completing Form 4506-T, Request for Transcript of Tax Return or Form 4506-T-EZ, Short Form Request for Individual Tax Return Transcript and mailing it to the address listed in the

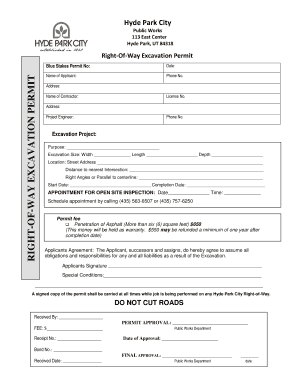

Related templates