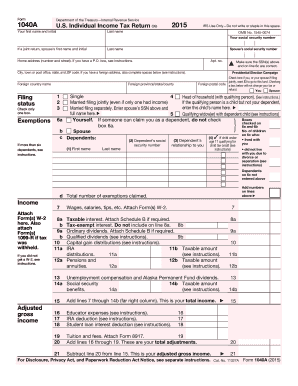

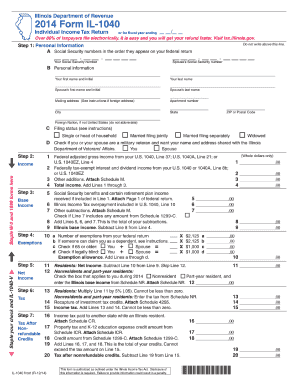

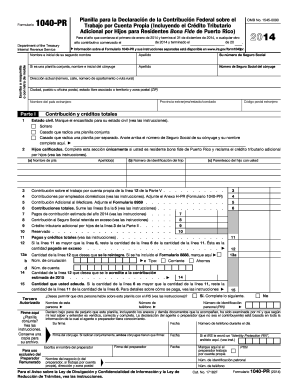

2014 Form 1040 - Page 2

What is 2014 Form 1040?

The 2014 Form 1040 is the standard individual income tax return form that taxpayers use to report their annual income and calculate their tax liability for the year 2014. It is used by both employed individuals and self-employed individuals to report their income, deductions, and credits to the Internal Revenue Service (IRS). Filling out this form accurately and timely is an important responsibility for every taxpayer.

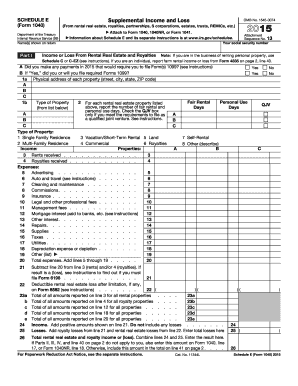

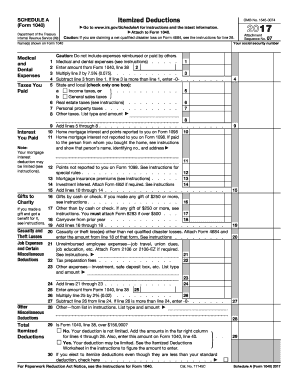

What are the types of 2014 Form 1040?

The 2014 Form 1040 comes in several variations, depending on the complexity of the taxpayer's financial situation. The main types of 2014 Form 1040 include:

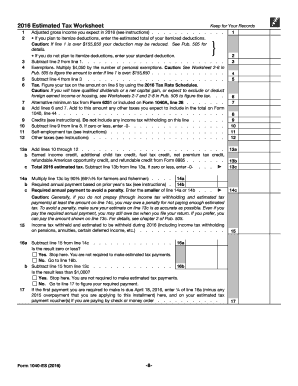

How to complete 2014 Form 1040

Completing the 2014 Form 1040 involves several steps to accurately report your income and claim any applicable deductions or credits. Here is a general guide to help you complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently and effortlessly.