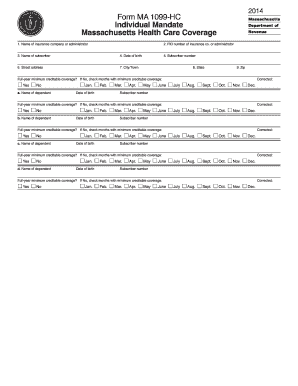

2014 Form 1099-misc

What is 2014 form 1099-misc?

The 2014 form 1099-misc is a tax form used by businesses to report payments made to non-employees. It is specifically used for independent contractors, freelancers, and other self-employed individuals. The form documents various types of income, such as rent, royalties, and miscellaneous payments.

What are the types of 2014 form 1099-misc?

There are several types of income that can be reported on the 2014 form 1099-misc. These include:

Rent payments

Royalties

Nonemployee compensation

Prizes and awards

Gross proceeds paid to attorneys

Crop insurance proceeds

Medical and healthcare payments

How to complete 2014 form 1099-misc

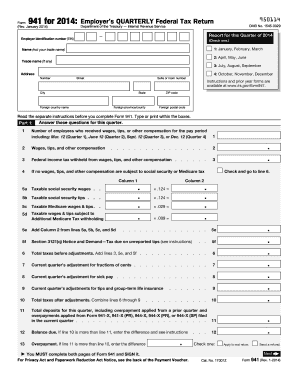

Completing the 2014 form 1099-misc is a straightforward process. Here are the steps you need to follow:

01

Gather all the necessary information, including the recipient's name, address, and taxpayer identification number (TIN).

02

Enter your own information as the payer, including your name, address, and TIN.

03

Fill out the appropriate boxes on the form, reporting the different types of income.

04

Double-check all the information entered to ensure accuracy.

05

Submit copies to the recipients and the IRS by the designated deadlines.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2014 form 1099-misc

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How can I get a copy of my 1099 MISC online?

To order the transcript, simply visit IRS.gov online and submit your request through the Get Transcript tool. You must make sure to order the Wage and Income Transcript that includes all the data it receives about various IRS forms that are used for informational wage reporting, such as Form 1099s and Forms W-2.

Can I get my old 1099 online?

Receive Form 1099G Form 1099G tax information is available for up to five years through UI Online.

How can I find my old 1099 online?

Request a Copy of Your Form 1099G Log in to Benefit Programs Online and select UI Online. Select Payments. Select Form 1099G. Select View next to the desired year. Select Print to print your Form 1099G information. Select Request Duplicate to request an official paper copy.

How many years can you wait to file a 1099?

The 1099 statute of limitations is three years. To further clarify, those three years begin on the due date of the return, or on the date it was filed. For example, if you file your 1099 on time next year, on January 31st 2021, the statute of limitations expires on January 31, 2024.

What if I forgot to file a 1099 last year?

Amending your tax return If you catch the error before the IRS does, then you should file an amended tax return using Form 1040-X, Amended U.S. Individual Tax Return. Be sure to include a copy of the 1099 with the amended return and include a payment for any additional tax that you owe.

How far back can you 1099 someone?

What is the 1099 Statute of Limitations? The 1099 statute of limitations is three years. To further clarify, those three years begin on the due date of the return, or on the date it was filed.

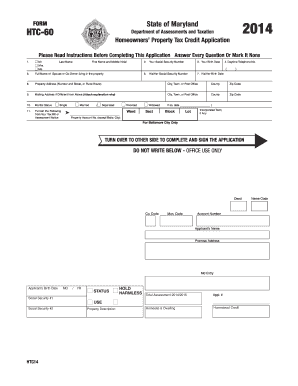

Related templates