2016 Form 540

What is 2016 form 540?

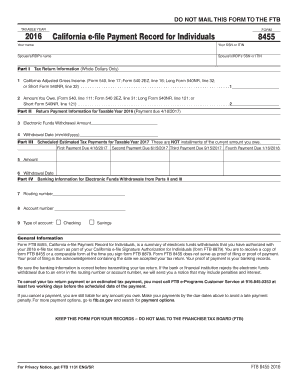

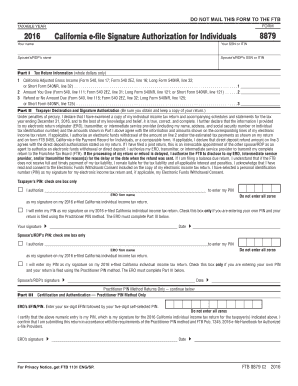

The 2016 form 540 is a tax form used by individuals to report their California state income tax. It is specifically designed for the tax year 2016 and helps taxpayers accurately report their income, deductions, credits, and calculate their tax liability for that year.

What are the types of 2016 form 540?

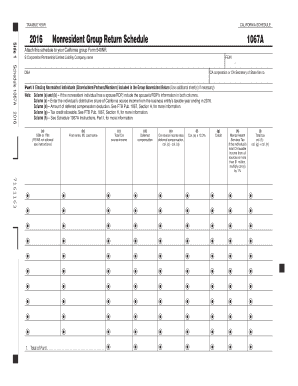

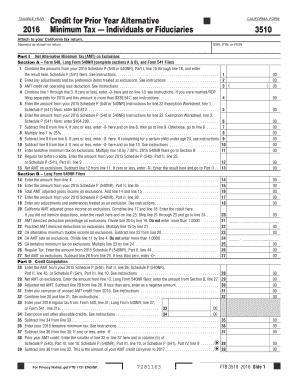

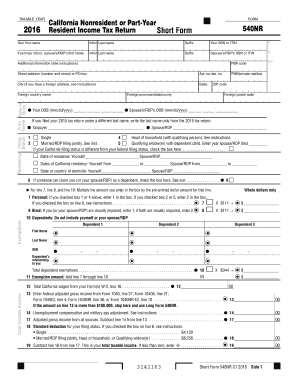

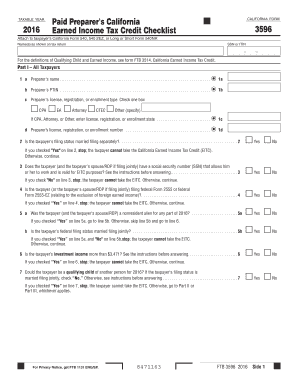

There are three types of 2016 form 540, each catering to different taxpayer situations: 1. Form 540 - Resident: This is for California residents who lived in the state for the entire tax year and need to report their worldwide income. 2. Form 540NR - Nonresident or Part-Year Resident: This form is for individuals who either did not reside in California for the entire year or have a nonresident status. It is used to report income earned in California only. 3. Form 540 2EZ - Easy Form: This is a simplified version of the form for taxpayers with straightforward tax situations, limited deductions, and no dependents.

How to complete 2016 form 540

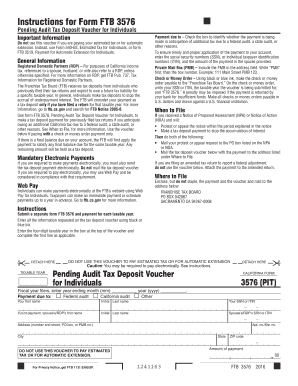

Completing the 2016 form 540 is a straightforward process. Here are the steps to follow: 1. Gather all your income-related documents, including W-2 forms, 1099 forms, and any additional income statements. 2. Fill in your personal information, such as your name, address, and Social Security Number. 3. Report your income accurately, taking into account different sources such as wages, self-employment income, rental income, and any other taxable income. 4. Deduct eligible expenses, credits, and deductions to reduce your taxable income. 5. Calculate your tax liability using the provided tax tables or the tax rate schedules. 6. Sign and date the form before mailing it to the appropriate address.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.