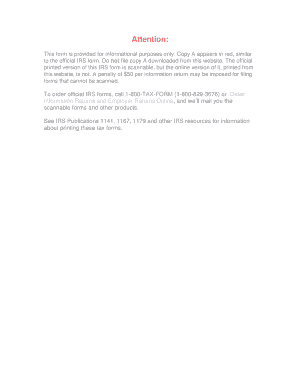

2016 Form 5498

What is 2016 form 5498?

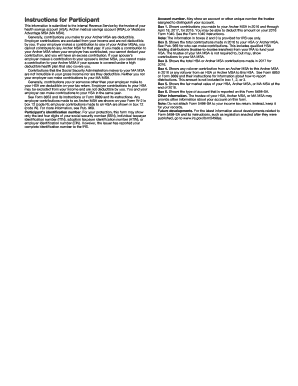

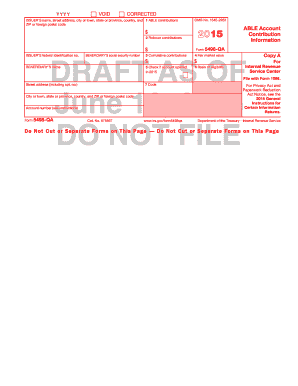

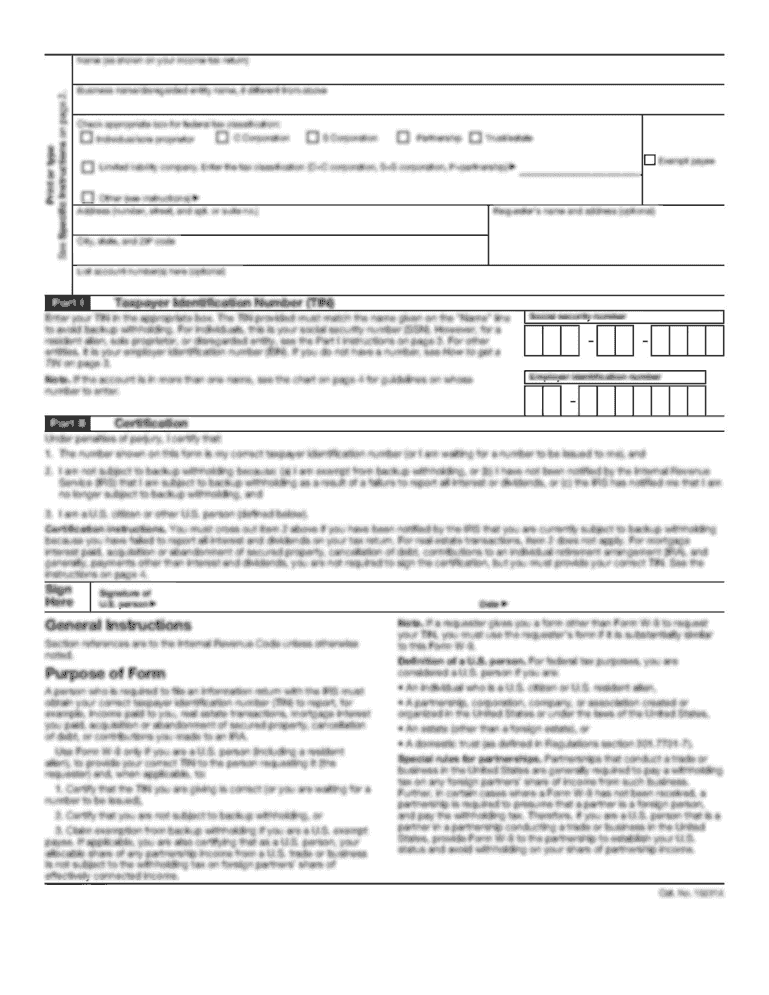

The 2016 form 5498 is a tax form used by individuals who have contributed to an individual retirement arrangement (IRA) during the year. It is used to report the contributions made to traditional, Roth, SEP, and SIMPLE IRAs. The form provides information about the amount of contributions made, the fair market value of the IRA, and any required minimum distributions.

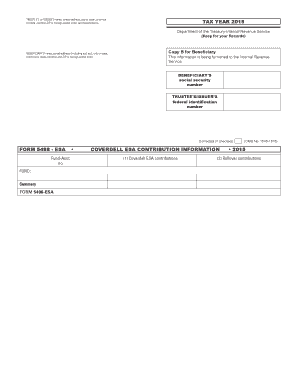

What are the types of 2016 form 5498?

There are several types of 2016 form 5498, depending on the type of IRA and the contributions made. The main types of form 5498 include:

How to complete 2016 form 5498

Completing the 2016 form 5498 is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.