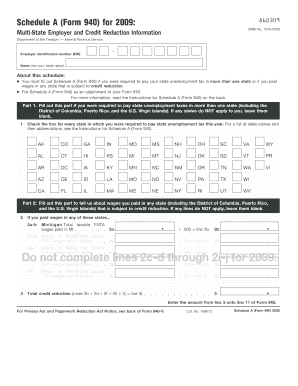

940 Pdf

What is 940 pdf?

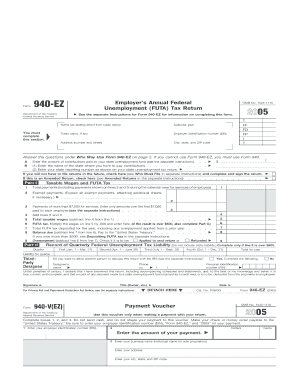

A 940 pdf is a type of document that is used for filing federal unemployment tax returns. The form 940 is utilized by employers to report their annual federal unemployment taxes. It is important for employers to accurately complete and file this form to fulfill their tax obligations.

What are the types of 940 pdf?

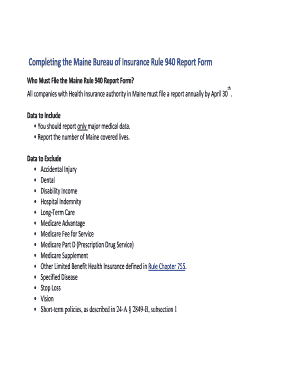

There are several types of form 940 that may be applicable to different situations. These types include: 1. Standard 940: This is the most commonly used form for reporting federal unemployment taxes. 2. Form 940-EZ: Employers with a smaller payroll or who meet certain criteria may be eligible to use this simplified version of form 940. 3. Form 940-PR: This form is specifically designed for employers in Puerto Rico to report their federal unemployment taxes. 4. Form 940-SS: Employers who pay wages to American Samoa or Commonwealth of the Northern Mariana Islands residents use this form. It's important to determine which type of form 940 is applicable to your specific circumstances before completing and submitting it.

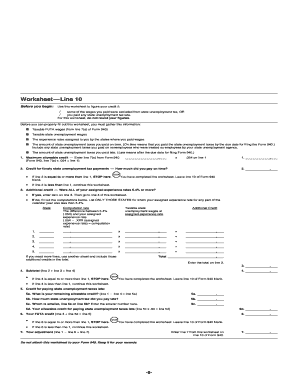

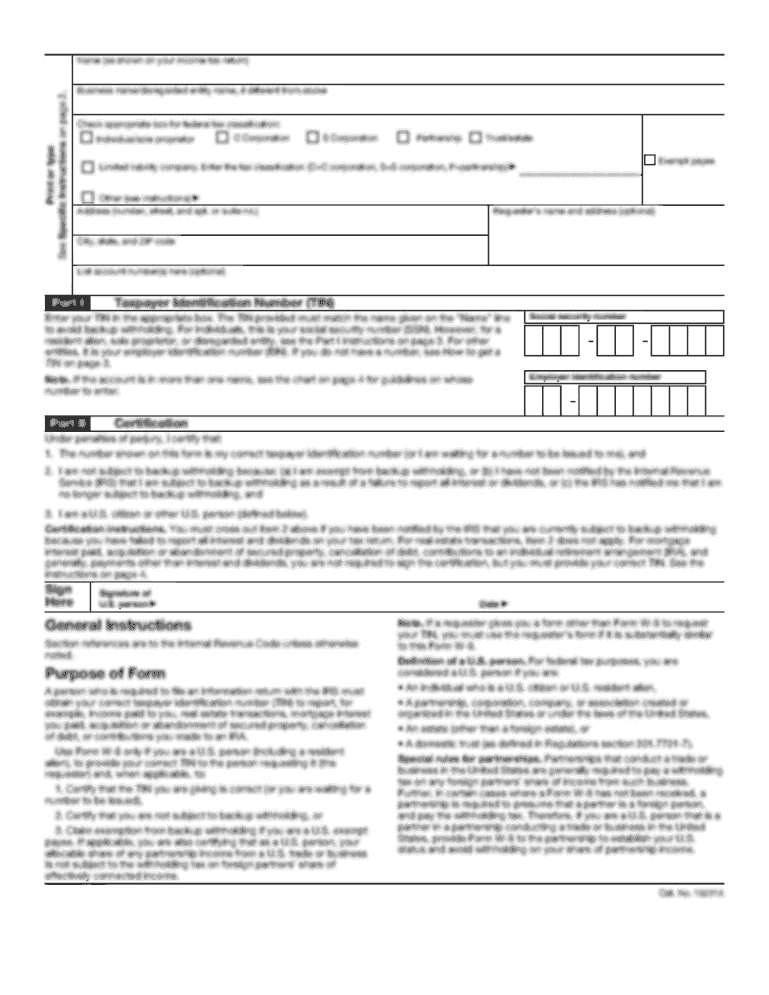

How to complete 940 pdf

Completing a 940 pdf can seem daunting, but with the right approach, it can be made simpler. Here are the steps to complete a 940 pdf:

By using pdfFiller, you can easily complete and submit your 940 pdf online. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done. With pdfFiller, completing your 940 pdf becomes a seamless and efficient process.