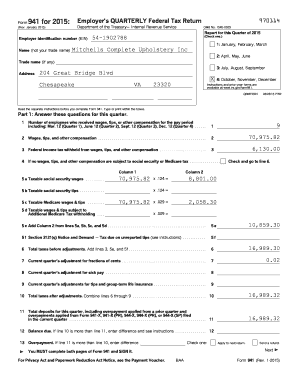

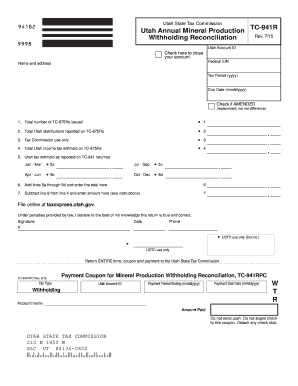

941 For 2015

What is 941 for 2015?

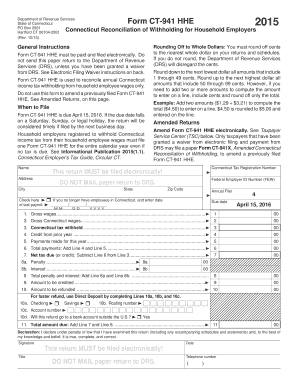

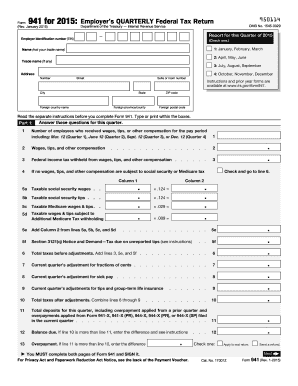

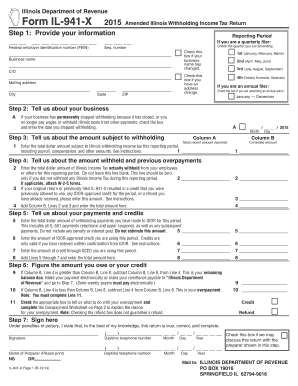

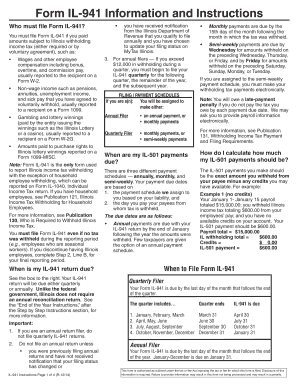

941 for 2015 is a tax form used by employers to report employment taxes to the Internal Revenue Service (IRS). It is specifically designed for the year 2015, and it is used to report the taxes related to social security, Medicare, and income tax withholding from employees' wages. This form helps employers fulfill their tax obligations and ensures that the appropriate taxes are paid to the government. It is an important document that must be filled out accurately and submitted timely.

What are the types of 941 for 2015?

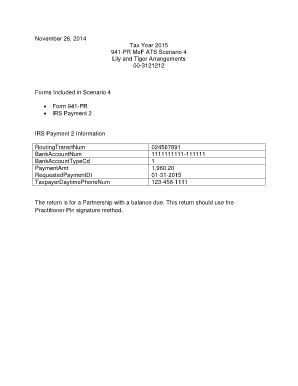

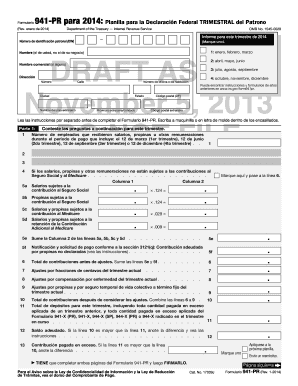

There are several types of 941 forms for 2015, depending on the circumstances of the employer: 1. Form 941: This is the standard form used by most employers to report employment taxes. 2. Form 941-SS: This form is specifically designed for employers in the U.S. territories, such as Puerto Rico and the U.S. Virgin Islands. 3. Form 941-PR: This form is used by employers who have employees in Puerto Rico but are not considered U.S. territories employers. Each form serves a specific purpose and must be filled out accordingly.

How to complete 941 for 2015

Completing the 941 form for 2015 requires careful attention to detail. Here are the steps to successfully complete the form: 1. Gather necessary information: Collect all the required details, including employer identification number (EIN), employee wages, tips, and withheld taxes. 2. Fill out the basic information: Enter your business name, address, and EIN in the designated boxes. 3. Report employee wages: Fill in the appropriate boxes with the total wages paid to employees during the given quarter. 4. Calculate and report taxes: Calculate the total amount of social security, Medicare, and income tax withholdings, and report them accurately in the respective sections. 5. Review and submit: Review the completed form for any errors or omissions, then sign and submit it to the IRS by the due date. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.