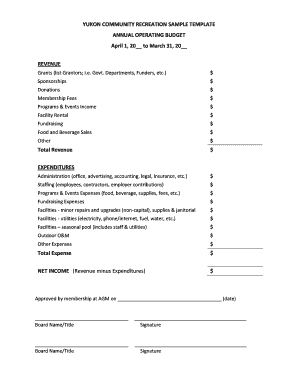

What is an annual operating budget template?

An annual operating budget template is a pre-designed document that helps individuals or businesses plan their expenses, revenue, and financial goals for the upcoming year. It provides a framework for organizing and analyzing financial data, ensuring that resources are allocated efficiently and goals are met. With an annual operating budget template, users can easily track their income and expenses, identify areas of financial improvement, and make informed decisions to achieve their financial objectives.

What are the types of annual operating budget templates?

There are several types of annual operating budget templates available to cater to different needs and preferences. Some common types include:

Basic Annual Operating Budget Template: This template includes essential categories such as revenue, expenses, and net income. It is suitable for individuals or small businesses with straightforward financial requirements.

Departmental Operating Budget Template: This template is designed to allocate budget resources to different departments within an organization. It helps in assessing the financial performance of each department and making informed managerial decisions.

Project-based Operating Budget Template: This template is specific to project-based businesses or organizations. It allows users to allocate funds to different projects, monitor project expenses, and evaluate the financial viability of each project.

Non-profit Annual Operating Budget Template: Non-profit organizations have unique financial needs, and this template caters to those requirements. It helps in tracking donations, grants, and expenses associated with non-profit activities.

Personal Annual Operating Budget Template: This template is ideal for individuals who want to track their personal income, expenses, and savings goals. It helps in maintaining financial discipline and planning for future financial milestones.

How to complete an annual operating budget template?

Completing an annual operating budget template requires the following steps:

01

Gather Financial Data: Collect all necessary financial records, including income statements, balance sheets, and cash flow statements. This data will provide insights into your current financial situation.

02

Identify Categories: Determine the specific categories that need to be included in your budget, such as revenue sources, direct costs, indirect costs, and operating expenses.

03

Set Financial Goals: Define your financial goals for the upcoming year. These goals can include increasing revenue, reducing expenses, or improving profit margins.

04

Allocate Resources: Distribute your budgeted resources among the identified categories based on past data and future projections. This will help you create a realistic and achievable budget plan.

05

Monitor and Adjust: Regularly monitor your budget versus actual performance and make necessary adjustments as needed. This will ensure that you stay on track and can adapt to any unexpected changes or challenges.

Empowering users to create, edit, and share documents online, pdfFiller offers unlimited fillable templates and powerful editing tools. As the only PDF editor users need to get their documents done, pdfFiller provides a convenient and efficient platform for managing financial documents and creating professional budgets.