What is Annuity Calculator?

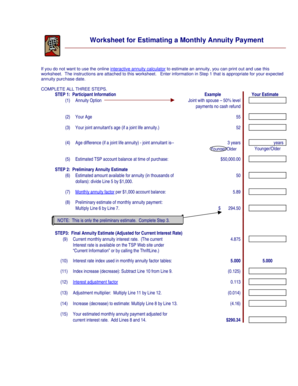

An Annuity Calculator is a helpful tool that allows individuals to estimate the future value of an annuity investment. It takes into account factors such as the initial principal, interest rate, and time period to provide an accurate prediction of the investment's growth.

What are the types of Annuity Calculator?

There are various types of Annuity Calculators available to cater to different financial needs. Some common types include:

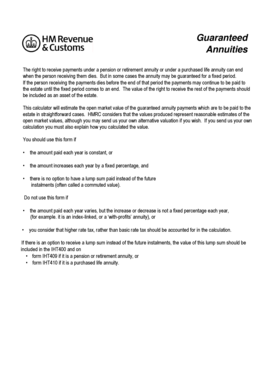

Fixed Annuity Calculator: This calculator helps calculate the future value of a fixed annuity where the interest rate remains constant throughout the investment period.

Variable Annuity Calculator: This calculator considers the fluctuating market conditions and allows individuals to estimate the future value of a variable annuity investment.

Immediate Annuity Calculator: This calculator is used to determine the future payouts and income generated by an immediate annuity investment.

Deferred Annuity Calculator: With this calculator, individuals can estimate the growth of a deferred annuity over a specific period of time.

Indexed Annuity Calculator: This calculator helps project the future value of an indexed annuity, which is tied to a specific financial index.

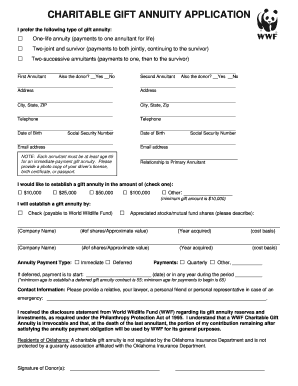

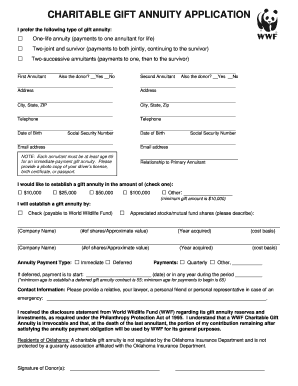

Joint and Survivor Annuity Calculator: This calculator provides estimates for annuities that are designed to provide income for both the annuitant and a surviving beneficiary.

How to complete Annuity Calculator

Completing an Annuity Calculator is a straightforward process. Follow these steps to get accurate results:

01

Gather the necessary information: Collect details such as initial principal, interest rate, time period, and any additional contributions or withdrawals.

02

Select the appropriate type of Annuity Calculator: Choose the calculator that aligns with your specific annuity investment.

03

Enter the required values: Input the gathered information into the calculator fields.

04

Review and analyze the results: Once all the data is entered, the calculator will provide the estimated future value of your annuity investment.

05

Make adjustments if needed: If the calculated results are not satisfactory, you can make adjustments to the inputs and recalculate until you find a desirable outcome.

With pdfFiller's Annuity Calculator, you can conveniently estimate the future growth of your annuity investment. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.