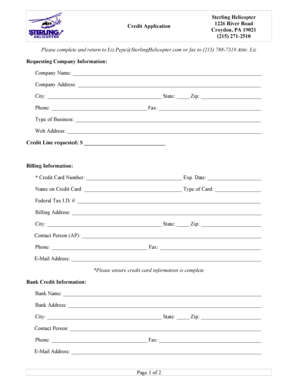

Auto Credit Application Template

Video Tutorial How to Fill Out auto credit application template

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I apply for credit for the first time?

Here are four ways to get started. Apply for a Credit Card. Lack of credit history could make it difficult to get a traditional unsecured credit card. Become an Authorized User. Set Up a Joint Account or Get a Loan With a Co-Signer. Take Out a Credit-Builder Loan.

What is required for a credit application?

Credit Application Information Mainstream lenders will typically look for a credit score of 650 or higher with a debt to income ratio of 35% or less. Each individual lender, however, will have their own standards for credit underwriting and credit approval.

What is a credit application letter?

Letter of Credit Application means an application requesting such Issuing Lender to issue a Letter of Credit and a reimbursement agreement, in each case in the form specified by the applicable Issuing Lender from time to time.

What is application for credit terms?

A credit application is a request for an extension of credit. Credit applications can be done either orally or in written form, usually through an electronic system.

Is an application for credit a contract?

The Credit Application as a Contract The properly executed credit application is a binding contract when there is agreement to terms and conditions. Remember, the process of obtaining the signed application is a negotiation.

What is a credit application for a car?

A credit application is a request for a loan or line of credit. The information included in a credit report helps the lender determine whether the borrower is a good candidate for a loan. You can usually fill out a credit application either online or in person.

Related templates