Auto Loan Rates

What is auto loan rates?

Auto loan rates refer to the interest rates that are charged on loans specifically for purchasing a vehicle. When individuals borrow money to buy a car, they have to pay back the loan amount along with the interest charged by the lender. This interest rate is commonly known as the auto loan rate. The auto loan rate determines the cost of borrowing and can vary based on several factors, such as credit score, loan term, and the lender.

What are the types of auto loan rates?

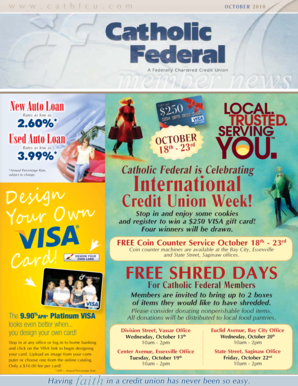

There are two main types of auto loan rates: 1. Fixed Auto Loan Rates: This type of auto loan rate remains constant throughout the entire loan term. It provides borrowers with a predictable monthly payment amount as the interest rate does not change over time. 2. Variable Auto Loan Rates: Unlike fixed auto loan rates, variable rates can fluctuate over time. These rates are usually linked to a benchmark such as the prime rate or the LIBOR rate. Borrowers with variable auto loan rates may experience changes in their monthly payment amounts depending on any changes in the benchmark rate.

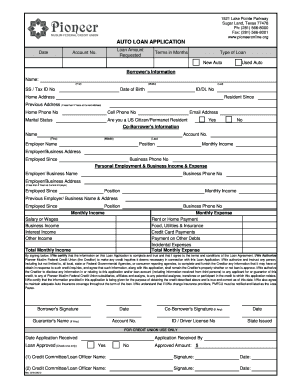

How to complete auto loan rates

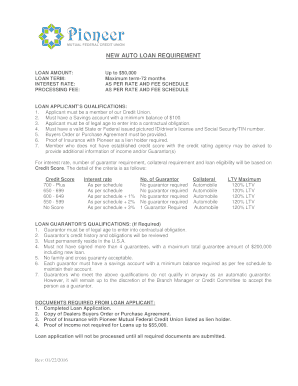

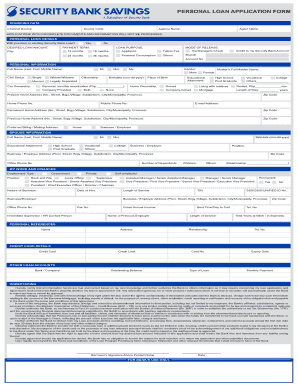

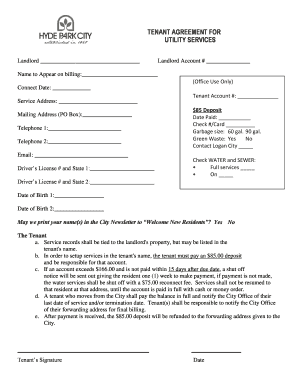

Completing auto loan rates is relatively simple and can be done by following these steps: 1. Research Lenders: Start by researching different lenders and their auto loan rates. Look for reputable lenders who offer competitive rates. 2. Check Credit Score: Before applying for an auto loan, check your credit score. A higher credit score may give you access to better auto loan rates. 3. Compare Loan Terms: Compare different loan terms offered by lenders. Consider the length of the loan and monthly payment amounts. 4. Gather Required Documents: Gather all the necessary documents required by the lender, such as proof of income, identification, and vehicle information. 5. Apply for Loan: Once you have selected a lender, submit your loan application along with the required documents. 6. Review Loan Terms: Carefully review the loan terms and conditions provided by the lender. Ensure that you understand the interest rate, repayment schedule, and any additional fees. 7. Sign and Accept: If you are satisfied with the loan terms, sign the loan agreement and accept the auto loan rates offered by the lender.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.