Balancing Your Checking Account Worksheet Answers

Video Tutorial How to Fill Out balancing your checking account worksheet answers

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why can't I balance my checkbook?

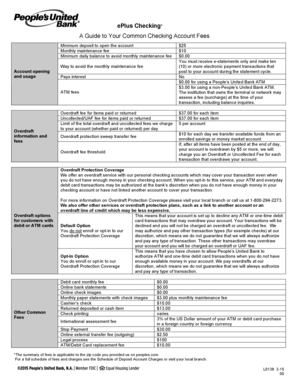

Even if you record all of your checking account charges, withdrawals, checks, and deposits in your checkbook, your balance may not match the amount on your bank statement. This could be due to transactions that haven't yet registered at your bank—or it could be an error that you or the bank made.

What does it mean to balance a checking account?

The process of balancing your account simply involves listing your debits and credits (deposits and withdrawals), and adding them up to determine your balance. It can be done using pen and paper or money management software.

How do you write a check and balance a checkbook?

Check out our quick how-to. Step 1: Date the check. Write the date on the line at the top right-hand corner. Step 2: Who is this check for? Step 3: Write the payment amount in numbers. Step 4: Write the payment amount in words. Step 5: Write a memo. Step 6: Sign the check.

What is it called when you balance your checking account?

Balancing your checkbook, which is also known as reconciling your account, is basically about making sure that the records you have kept for your financial transactions match those the bank lists on your statement.

What are the steps to balancing your checking account?

How to Balance a Checkbook in 5 Steps Step 1: Write Down Your Transactions Often. Step 2: Open Your Checking Account Statement. Step 3: Check All Transactions. Step 4: Update Your Balance. Step 5: Repeat.

Do you really need to balance your checkbook?

Why Balance Your Checkbook? Even today, when much (if not all) of your transaction information is available with the click of a button, it's still a good idea to maintain a record of your transactions and regularly balance that record.

Related templates