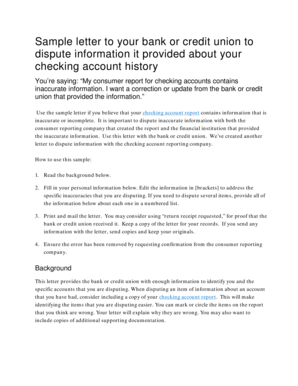

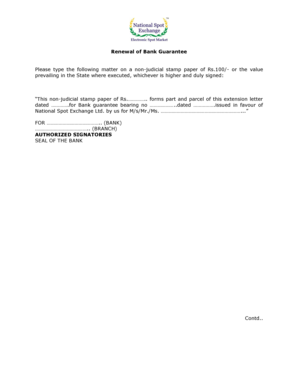

What is bank guarantee sample letter?

A bank guarantee sample letter is a document that serves as a written confirmation from a financial institution to ensure the payment of a specific amount of money if the beneficiary fails to meet the agreed terms or defaults on their obligations. It provides a sense of security and reassurance to the recipient, as it guarantees that the financial institution will bear the financial liability in case of non-performance or default by the party mentioned in the letter.

What are the types of bank guarantee sample letter?

There are various types of bank guarantee sample letters that can be used based on the specific requirements of different situations. Some common types of bank guarantee sample letters include:

Performance Guarantee: This type of guarantee is issued to ensure the satisfactory completion of a particular project, contract, or task by the party mentioned in the letter.

Payment Guarantee: This guarantee ensures that the financial institution will make the payment on behalf of the applicant in case they fail to meet their payment obligations.

Bid Bond Guarantee: This type of guarantee is used in the bidding process and assures the project owner that the bidder will enter into the contract and provide the necessary performance guarantee if awarded the contract.

Advance Payment Guarantee: This guarantee is issued to ensure the repayment of an advance payment made by the beneficiary to the party mentioned in the letter if they fail to carry out their agreed obligations.

Financial Guarantee: This guarantee is issued to assure the financial stability of a company and its ability to meet its financial obligations.

Customs Guarantee: This type of guarantee ensures that the party mentioned in the letter will meet its obligations related to customs duties and taxes when importing or exporting goods.

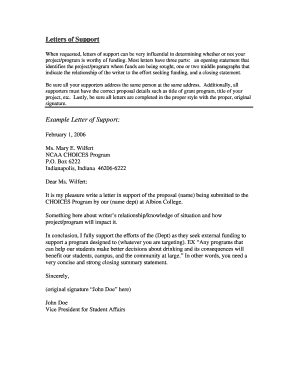

How to complete bank guarantee sample letter

Completing a bank guarantee sample letter involves the following steps:

01

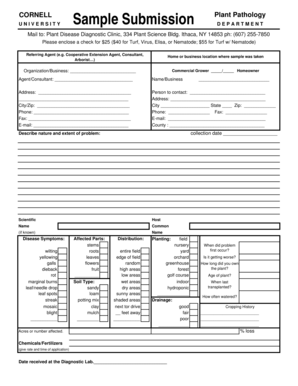

Include the name and contact details of the applicant (sender) and recipient of the guarantee.

02

Specify the type of guarantee being issued and provide a brief description of the purpose.

03

Clearly state the amount of guarantee and the currency in which it is issued.

04

Include the validity period of the guarantee, which indicates the duration for which the guarantee will be in effect.

05

Provide any specific terms or conditions related to the guarantee, such as performance milestones or payment schedules.

06

Include any supporting documents or attachments required, such as contract agreements or project details.

07

Sign and date the letter to validate it.

08

Submit the letter to the recipient for review and acceptance.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.