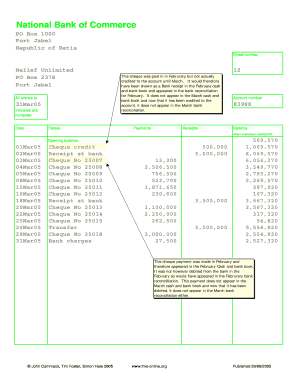

Bank Reconciliation Example

Description of a bank reconciliation

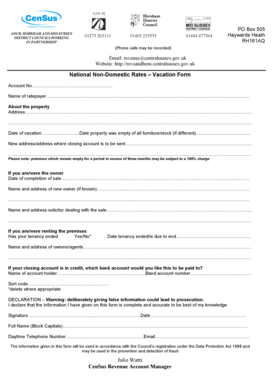

A bank reconciliation is a document for conducting a check between bank`s and individual`s records. It is a perfect way to find any financial mistakes or unrecorded transactions. Such document is presented to a client every month or at any time by his/her request in order to confirm if all the data provided is true and correct. If there are any discrepancies, a person should immediately inform bank officials about them. A bank reconciliation is usually prepared on the basis of a bank statement that includes data about transactions for certain period such as money transfers, withdrawals etc.

How to prepare a bank reconciliation?

Composing a bank reconciliation is an important procedure that requires great attention. First, you should start with gathering all necessary data. You won`t have any problems with preparing a document, if you download several fillable reconciliation form templates. Choose the most appropriate one and start to insert the data.

A bank reconciliation has to contain the following:

After a document is complete, check if all provided information is correct and all empty lines are filled in. A bank reconciliation form has to be signed by a bank official and submitted to a recipient for approval. For convenience, a person may fill out, sign and submit a blank reconciliation form template online or download on a computer.