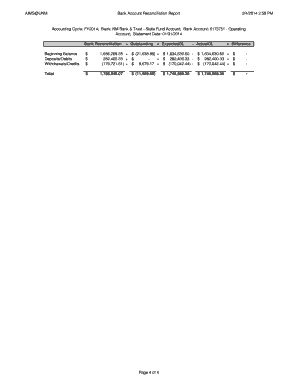

Bank Reconciliation Questions And Answers Pdf

What is bank reconciliation questions and answers pdf?

Bank reconciliation questions and answers pdf is a document that provides a set of frequently asked questions and their corresponding answers regarding the process of bank reconciliation. This document is typically in a portable document format (PDF) for easy access and distribution. It serves as a helpful resource for individuals or businesses who want to understand the concepts and procedures involved in bank reconciliation.

What are the types of bank reconciliation questions and answers pdf?

Bank reconciliation questions and answers pdf covers various types of bank reconciliation scenarios and their corresponding questions. Some common types include:

How to complete bank reconciliation questions and answers pdf

Completing a bank reconciliation questions and answers pdf involves following a series of steps to ensure accuracy and completeness. Some key steps to complete the bank reconciliation process are:

By using pdfFiller, users can easily create, edit, and share their bank reconciliation questions and answers pdf documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the go-to PDF editor for individuals and businesses looking to efficiently manage their documents.