What is Bank Reconciliation Sample Reports?

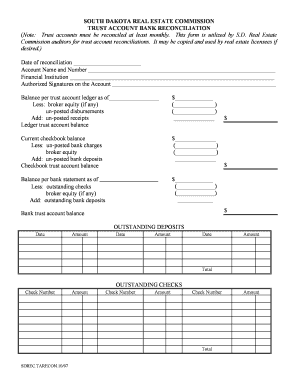

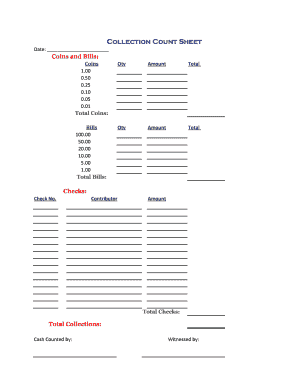

Bank Reconciliation Sample Reports are detailed financial documents that provide a summary of a company's financial transactions. These reports help businesses reconcile their bank statements with their accounting records to ensure accuracy and identify any discrepancies. By comparing the transactions listed in the bank statement to those recorded in the accounting system, businesses can ensure that their financial records are complete and accurate.

What are the types of Bank Reconciliation Sample Reports?

There are several types of Bank Reconciliation Sample Reports, including:

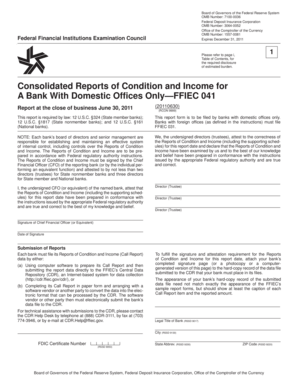

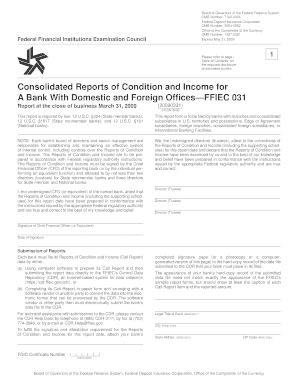

Monthly Bank Reconciliation Report: This report is prepared on a monthly basis and provides a detailed analysis of the transactions recorded in the bank statement and the accounting system.

Quarterly Bank Reconciliation Report: This report is prepared quarterly and includes a summary of the financial transactions recorded during that period.

Annual Bank Reconciliation Report: This report is prepared annually and provides a comprehensive overview of the financial transactions for the entire year.

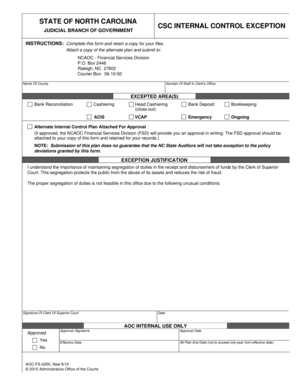

Exception Reports: These reports are generated when there are discrepancies or exceptions identified during the reconciliation process. They help businesses investigate and resolve any issues.

How to complete Bank Reconciliation Sample Reports

Completing Bank Reconciliation Sample Reports can be done by following these steps:

01

Gather all relevant documents, including bank statements, accounting records, and any supporting documents.

02

Compare the transactions listed in the bank statement with those recorded in the accounting system.

03

Identify any discrepancies and investigate the reasons behind them.

04

Make necessary adjustments to the accounting records to ensure they match the bank statement.

05

Prepare a reconciliation report summarizing the findings and documenting any adjustments made.

06

Review and double-check the report for accuracy.

07

Keep a copy of the report for future reference and auditing purposes.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.