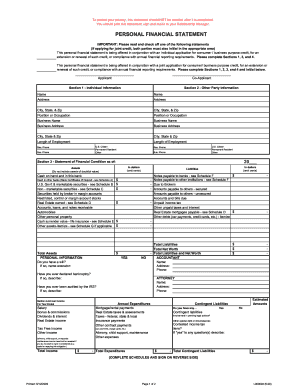

What is Bank Reconciliation Template?

A Bank Reconciliation Template is a tool that helps individuals or businesses compare their bank statement records with their own financial records. It is used to identify any discrepancies or errors in the financial transactions and ensure that the bank statement matches the accounting records.

What are the types of Bank Reconciliation Template?

There are different types of Bank Reconciliation Templates available depending on the specific needs of individuals or businesses. Some common types include:

Basic Bank Reconciliation Template: This template is suitable for individuals or small businesses with simple financial transactions.

Advanced Bank Reconciliation Template: This template is more comprehensive and includes additional features for businesses with complex financial transactions or multiple bank accounts.

Automated Bank Reconciliation Template: This template uses automation tools or software to streamline the reconciliation process and save time.

Excel Bank Reconciliation Template: This template is designed using Microsoft Excel and provides a user-friendly interface for reconciling bank statements.

How to complete Bank Reconciliation Template

Completing a Bank Reconciliation Template is a straightforward process that involves the following steps:

01

Gather necessary records: Collect bank statements, financial records, and any supporting documents.

02

Compare records: Match each transaction on the bank statement with the corresponding entry in your financial records.

03

Highlight discrepancies: Note any differences or errors between the bank statement and your records. Investigate and resolve these discrepancies.

04

Adjust balances: Make adjustments to your financial records to ensure they align with the bank statement.

05

Reconcile totals: Calculate the new balance by adding or subtracting any adjustments made.

06

Document the reconciliation: Record the reconciliation process and any notes or explanations for future reference.

07

Store and review: Save the completed Bank Reconciliation Template and review it regularly to ensure accuracy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.