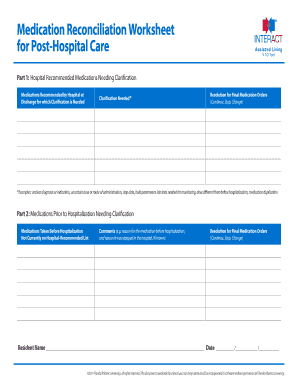

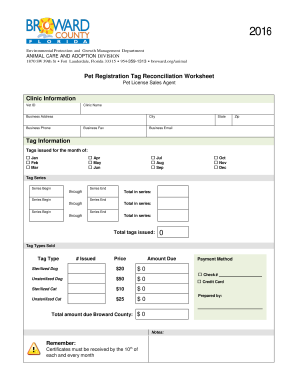

Bank Reconciliation Worksheet

What is a bank reconciliation worksheet?

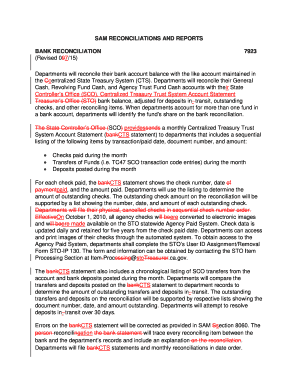

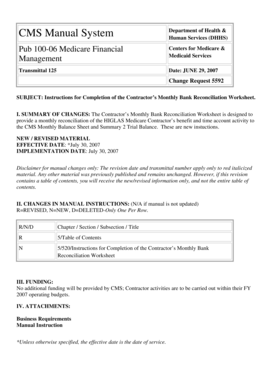

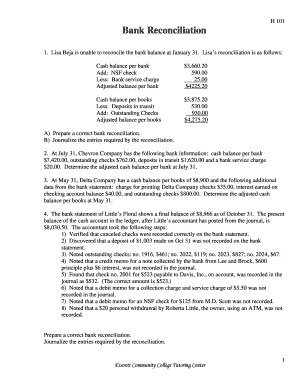

A bank reconciliation worksheet is a tool used by businesses to compare their own records of financial transactions with the information provided by their bank. It helps to ensure that the company's records match the bank's records and identify any discrepancies or errors that may need to be corrected.

What are the types of bank reconciliation worksheet?

There are two main types of bank reconciliation worksheets: 1. Manual Bank Reconciliation Worksheet: This involves manually comparing the company's records and bank statements to identify discrepancies. It requires more time and effort but provides a detailed analysis of the transactions. 2. Automated Bank Reconciliation Worksheet: This is done using accounting software or online tools that import the bank statements and automatically match them with the company's records. It is quicker and less prone to errors compared to manual reconciliation.

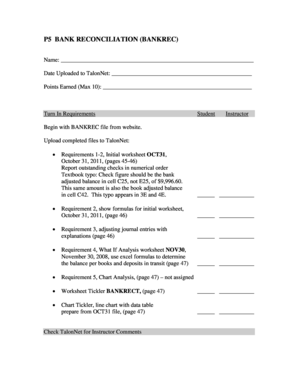

How to complete a bank reconciliation worksheet

Completing a bank reconciliation worksheet is an important task to ensure the accuracy of financial records. Here's a step-by-step guide: 1. Gather the necessary documents: Collect the bank statements, checkbooks, and the company's financial records. 2. Compare records: Match each transaction in the bank statement with the corresponding entry in the company's records. 3. Identify discrepancies: Highlight any differences between the bank statement and the company's records. 4. Investigate discrepancies: Look for missing transactions, errors in amounts, or any other discrepancies. 5. Make adjustments: Make the necessary adjustments in the company's records to match the bank's records. 6. Reconcile: Once all the discrepancies are resolved, reconcile the differences and ensure the final balances in both sets of records match.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.