What is Bi-weekly Budget Template?

A bi-weekly budget template is a tool that helps individuals or households to manage their finances by planning and tracking their income and expenses on a bi-weekly basis. This template allows users to organize their finances, set financial goals, and make informed decisions about their spending and saving. By using a bi-weekly budget template, users can effectively manage their cash flow and ensure that they have enough money to cover their expenses and save for the future.

What are the types of Bi-weekly Budget Template?

There are various types of bi-weekly budget templates available to suit different needs and preferences. Some common types include:

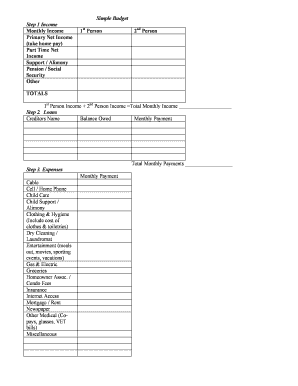

Simple bi-weekly budget template: This basic template includes categories for income, expenses, and savings.

Detailed bi-weekly budget template: This template provides more specific categories for different types of expenses such as groceries, transportation, and entertainment.

Digital bi-weekly budget template: This type of template can be filled out electronically to easily calculate totals and make adjustments.

Family bi-weekly budget template: Designed for larger households, this template allows users to track income and expenses for multiple family members.

Business bi-weekly budget template: Tailored for entrepreneurs and small business owners, this template helps to manage business-related income and expenses.

How to complete Bi-weekly Budget Template

Completing a bi-weekly budget template can be a straightforward process. Here are some steps to follow:

01

Begin by listing all sources of income for the bi-weekly period, such as salaries, bonuses, or side hustles.

02

Next, list all fixed expenses that occur bi-weekly, such as rent/mortgage payments, utility bills, or loan repayments.

03

Estimate and list variable expenses for the bi-weekly period, such as groceries, transportation, and entertainment.

04

Deduct the total expenses from the total income to determine the available discretionary income.

05

Allocate the discretionary income towards savings, debt repayments, or other financial goals.

06

Regularly track and update the budget template to ensure accurate financial planning.

With pdfFiller, users can easily create, edit, and share their bi-weekly budget templates online. The platform offers unlimited fillable templates and powerful editing tools, making it the only PDF editor users need to effectively manage their finances. Start using pdfFiller today and take control of your budgeting journey!