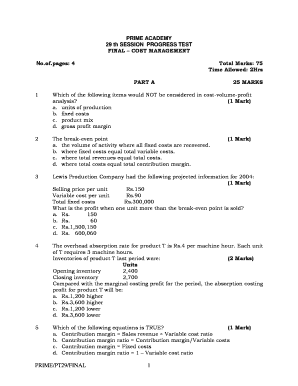

What is Break Even Analysis Template?

A Break Even Analysis Template is a financial tool used to determine the point at which revenues equal expenses, resulting in a break-even point. It helps businesses understand how many units or dollars they need to sell to cover their costs and start generating profit. This template provides a framework for analyzing and forecasting the financial performance of a business.

What are the types of Break Even Analysis Template?

There are several types of Break Even Analysis Templates available, each suited for different business scenarios. Some common types include:

Simple Break Even Analysis Template: This basic template calculates the break-even point by considering fixed costs, variable costs, and selling price per unit.

Contribution Margin Break Even Analysis Template: This template calculates the break-even point by analyzing the contribution margin per unit, which is the difference between selling price per unit and variable cost per unit.

Multi-Product Break Even Analysis Template: This type of template is useful for businesses that sell multiple products with different cost and price structures. It helps determine the overall break-even point of the product mix.

Cost-Volume-Profit Analysis Template: This template takes into account not only the break-even point but also analyzes the sales volume required to achieve a target profit level.

Break Even Chart Template: This visual template represents the break-even analysis graphically, showing the relationship between sales volume, costs, and profit.

How to complete Break Even Analysis Template

Completing a Break Even Analysis Template is simple and straightforward. By following these steps, you can effectively analyze your business's financial performance:

01

Gather financial data: Collect the relevant financial information, including fixed costs, variable costs, selling price per unit, and any other relevant data.

02

Calculate the break-even point: Use the template's formulas or equations to calculate the break-even point based on the gathered data.

03

Analyze the results: Interpret the break-even point, understanding what it means for your business's profitability and financial stability.

04

Consider different scenarios: Use the template to explore various scenarios by adjusting the variables, such as changing the selling price per unit or the fixed costs, to see the impact on the break-even point and profitability.

05

Make informed decisions: Use the insights gained from the analysis to make informed decisions about pricing, production volume, cost management, and overall business strategy.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.